Regulatory compliance consulting helps you figure out which laws apply to your business, build workable rules and controls, and prove that you follow them. In plain terms, a consultant translates legal and regulatory obligations into daily practice—policies, checklists, training, monitoring, and audit trails—so you can operate with confidence and avoid fines. In the Netherlands, that often means aligning with Dutch and EU requirements and, where relevant, engaging with authorities such as the AP (privacy), AFM and DNB (financial), ACM (competition/consumer), ILT (transport), NVWA (food/product), and local municipalities.

This guide gives you a practical overview of regulatory compliance consulting in the Netherlands. You’ll learn what these services cover, the Dutch/EU rules you’ll face, when to seek help, how engagements run, what deliverables to expect, and typical timelines and costs. We’ll compare in-house, outsourced, and fractional models, highlight useful technology, explain how to handle audits and inspections, flag common pitfalls, and share criteria for choosing the right partner—so you can decide your next step with clarity.

What regulatory compliance consulting covers in practice

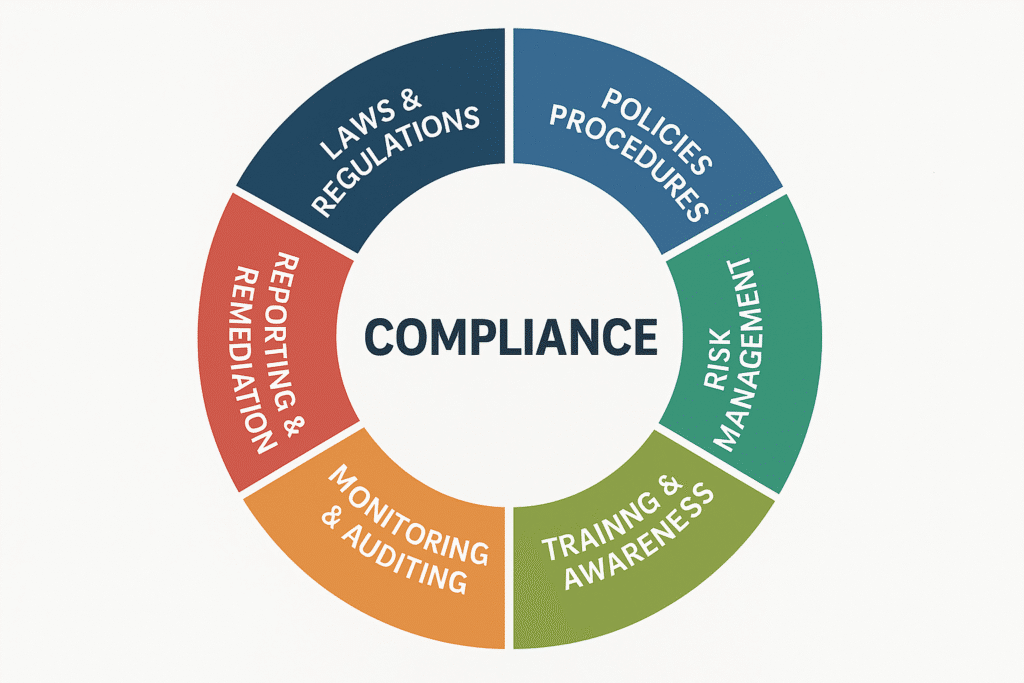

In day-to-day terms, consultants turn legal obligations into structured work. They map applicable Dutch/EU rules to your processes, build controls that people actually use, and create evidence regulators accept. The outcome is fewer surprises, smoother audits, and a compliance program that fits your size, sector, and risk profile.

- Regulatory gap analysis: Compare current practices to Dutch/EU requirements and standards.

- Risk assessment and control design: Prioritize risks; embed practical controls into workflows.

- Policies, procedures and training: Write, implement, and educate teams for consistent execution.

- Monitoring and internal audits: Test controls, track issues, and verify remediation.

- Licensing and inspection readiness: Prepare files, brief staff, and manage regulator queries.

- Reporting and governance: Define KPIs, dashboards, and compliance committee routines.

- Technology enablement: Advise on GRC, privacy, and case-management tools for traceability.

The Dutch and EU regulatory landscape you must navigate

In the Netherlands, you rarely deal with a single rulebook. Most organizations face EU regulations layered with Dutch statutes and sector guidance, then local permits and inspections. Effective regulatory compliance consulting connects these layers, clarifies who regulates what, and builds a coherent plan you can execute and evidence.

- Privacy and data (AP): EU GDPR/AVG compliance, DPIAs, data subject rights, breach response.

- Financial supervision (AFM/DNB): Licensing, conduct and prudential rules, governance, reporting.

- Competition and consumer (ACM): Fair competition, pricing/advertising claims, consumer rights.

- Product and food safety (NVWA): Market access, labeling, traceability, recalls, incident reporting.

- Transport and environment (ILT): Permits, safety management, environmental conditions, inspections.

- Municipal requirements: Zoning, building/use permits, hospitality and events, local by-laws.

Who needs regulatory compliance consulting in the Netherlands

Organizations that touch regulated activities or personal data benefit from regulatory compliance consulting. If you operate cross‑border, handle consumer funds, sell regulated products, or rely on permits, you likely need support. Dutch SMEs and multinationals alike—as well as public bodies and NGOs—use consultants to translate EU/Dutch rules into workable controls and evidence. Typical users include fintech, SaaS and e‑commerce, health and food businesses, logistics and energy operators, and manufacturers subject to market‑access and product rules.

When to seek help: common triggers and risk signals

You don’t need a fine or incident to justify regulatory compliance consulting. The best time is when change or uncertainty raises your exposure—and you want a structured, defensible program before a regulator, customer, or investor asks. If any of the below sound familiar, it’s time to get help.

- Entering a new market or launching a product: New licensing, AP/AFM/DNB/ACM/NVWA/ILT touchpoints.

- Regulator contact: Requests for information, inspections, or informal queries.

- Customer or bank due diligence: Detailed control questionnaires you can’t evidence.

- Incidents and near-misses: Data breaches, complaints, recalls, or audit findings.

- Rapid growth or M&A: Processes outgrowing controls; integrating policies and vendors.

- Key-person risk: Single compliance owner, outdated policies, or no testing cadence.

How a consulting engagement works from scoping to steady state

A well-run regulatory compliance consulting engagement in the Netherlands moves in clear stages, from discovery to a sustainable run-state. We begin by aligning scope, risks, and applicable regulators, then translate obligations into controls people actually use. The aim is predictable delivery, fewer surprises during audits, and accountability embedded in business-as-usual.

- Scoping and intake: goals, stakeholders, Dutch/EU rule map, authorities.

- Risk and gap assessment: evidence review, interviews, sampling.

- Prioritized roadmap: quick wins, owners, milestones, dependencies.

- Control design and build: policies, procedures, workflows, tooling.

- Training and change: role-based training, comms, acceptance testing.

- Monitoring and testing: KPIs, internal audits, remediation tracking.

- Regulator readiness and steady state: inspection packs, governance cadence.

Typical deliverables, documentation and timelines

Regulatory compliance consulting produces tangible, audit‑ready evidence you can hand to Dutch and EU supervisors. Expect phased delivery: first clarity (assessment and roadmap), then build (controls, policies, training), and finally proof (monitoring, metrics, inspection packs). Each tranche arrives with owners, acceptance criteria, and sign‑offs so you can demonstrate control at every step.

- Risk and gap report: prioritized roadmap tied to Dutch/EU obligations.

- Controls matrix and RACI: duties mapped to processes and owners.

- Policy/procedure suite: SOPs, templates, checklists, GDPR/AVG DPIA and breach playbooks.

- Training suite: role‑based plan, records, and attestations.

- Monitoring and testing: plan, scripts, and issue/remediation tracker.

- Licensing/inspection pack: evidence index, briefing notes, Q&A for AP/AFM/DNB/ACM/NVWA/ILT.

- Governance reporting: KPIs, dashboards, and committee materials to sustain compliance.

Costs and pricing models in the Netherlands

Costs hinge on scope, sector risk, regulator touchpoints (AP, AFM/DNB, ACM, NVWA, ILT), build versus remediation, and urgency. In the Netherlands, regulatory compliance consulting typically uses straightforward models that balance predictability and flexibility, with clear scoping and evidence‑ready outputs.

- Hourly: Law & More’s legal rates €250–€400 excl. VAT; ad‑hoc advice and drafting.

- Retainer: Monthly allocation for monitoring, advice‑on‑call, and audit prep.

- Day rate: Focused inspection readiness or on‑site regulator meetings.

Request a written scope, deliverables, and acceptance criteria before kickoff.

In-house, outsourced or fractional: choosing the right model

Choose an in‑house, outsourced, or fractional regulatory compliance consulting model based on risk, regulator touchpoints (AP, AFM/DNB, ACM, NVWA, ILT), and growth stage. Your model must assign owners, produce audit‑ready evidence, and keep costs predictable.

- In‑house: Maximum control; needs headcount, tooling, and cover for peaks.

- Outsourced: Deep expertise and surge capacity; require SLAs and knowledge transfer.

- Fractional/Hybrid: Senior part‑time leadership plus specialist support; ideal for SMEs and scale‑ups.

Using technology wisely: GRC, privacy and training tools

Tools should reduce risk and workload—not add complexity. In Dutch regulatory compliance consulting, we favor simple, auditable platforms that capture obligations, evidence and actions across GDPR/AVG and sector rules. Start small, integrate with your stack, and prioritize clear ownership and exportable records that the AP or sector supervisors will accept.

- GRC platform: obligations, controls, issues, dashboards, audit trails.

- Privacy management: ROPA, DPIAs, DSRs, breach log, retention.

- Training/LMS: role-based modules, attestations, reminders and tracking.

Engaging with Dutch regulators: audits, inspections and inquiries

Expect contact from Dutch regulators as desk RFIs, on‑site inspections, thematic reviews or interviews. Whether it’s the AP, AFM/DNB, ACM, NVWA or ILT, the aim is verification and remediation, not surprises. Effective regulatory compliance consulting structures the exchange, controls scope, and produces clean, consistent evidence that stands up under scrutiny.

- Prepare an inspection pack: org chart, policy register, latest procedures, training logs, incident registers, DPIAs, sample files, and evidence index.

- Appoint a single point of contact: manage questions, keep a log, ensure concise, accurate answers; have a note‑taker present.

- Use counsel to manage scope/privilege: clarify legal basis, narrow overbroad requests, agree timelines and formats.

- Demonstrate control operation: walkthroughs, sampling, screenshots, system logs—only what’s requested, nothing speculative.

- Respond in writing: confirm verbal discussions, submit a tracked action plan with owners and dates.

- Close out and govern: evidence remediation, brief the board, retain a complete regulator file, and update your monitoring plan.

Frequent pitfalls in Dutch compliance programs (and how to avoid them)

Even well‑intentioned teams in the Netherlands stumble on recurring issues. Programs read well on paper but fail in operation, evidence is patchy, and regulator questions get inconsistent answers. The fix is discipline and ownership: tie obligations to processes, prove control operation, and keep governance tight across AP, AFM/DNB, ACM, NVWA and ILT touchpoints.

- Policy without proof: no evidence. Fix: define evidence per control.

- One‑off projects: no monitoring. Fix: quarterly tests, issue log.

- Ambiguous ownership: vendor gaps. Fix: RACI, processor duties.

- Data overcollection: GDPR risk. Fix: purpose, retention, DPIAs.

- Unmanaged change: controls bypassed. Fix: gate in change process.

- Mixed messages to regulators: Fix: single POC, written minutes.

How to choose a compliance partner in the Netherlands

Choosing a compliance partner in the Netherlands means validating sector experience, Dutch/EU rule fluency, and the ability to produce audit‑ready evidence under time pressure. Favor pragmatic builders who map obligations to your processes, align governance with business goals, enable simple tooling, train your teams, and stand beside you during inspections.

- Proven regulator experience: AP, AFM/DNB, ACM, NVWA, ILT.

- Auditable method: risk/gap, roadmap, controls, testing.

- Sample deliverables: policies, DPIAs, inspection packs.

- Aligned with strategy: compliance tied to governance and KPIs.

- Senior access: Dutch/English fluency, named leads, escalation.

- Transparent scope/pricing: phased work or retainer, SLAs, evidence.

Next: what to expect when working with Law & More.

What to expect when working with Law & More

Engaging Law & More means senior legal guidance with practical build support. We start with a focused intake to map your Dutch/EU obligations and regulator touchpoints, then deliver audit‑ready policies, training, and evidence with clear owners and timelines. Communication is direct, multilingual, and accessible—even evenings and weekends.

- Named lead: a single point of contact plus clear escalation.

- Four-step method: acquaintance, case discussion, plan, handling.

- Pricing: €250–€400/hour excl. VAT; fixed‑fee phases where suitable.

- Regulator interface: preparation and attendance with AP/AFM/DNB/ACM/NVWA/ILT.

Key takeaways

Regulatory compliance consulting turns Dutch/EU obligations into daily practice you can prove. The payoff is fewer surprises, smoother audits, and confident growth. Focus on mapping the rules that apply to you, building usable controls, and keeping a clean evidence trail for AP, AFM/DNB, ACM, NVWA, and ILT. Get help early—especially around change.

- Map obligations and risks: tie EU/Dutch rules to processes.

- Build controls people use: policies, SOPs, and training.

- Prove it with evidence: logs, samples, dashboards, attestations.

- Prepare for regulators: inspection packs and a single POC.

- Choose the right model: in‑house, outsourced, or fractional.

- Sustain performance: monitoring, remediation, and governance cadence.

Need pragmatic, audit‑ready support? Speak with Law & More to scope a clear, costed plan.