Signing the deal was the easy part. Now two companies, two cultures, and countless systems must operate as one without losing customers, talent, or momentum. That delicate, high-pressure phase has a name: post-merger integration (PMI). Done well, PMI protects the purchase price and releases promised synergies; mishandled, it can erase value faster than the ink dried on the share-purchase agreement.

If you have just closed—or are about to close—a transaction, you likely need more than generic advice; you need a step-by-step playbook that starts during due diligence and guides you through Day 1, the first 100 days, and beyond. This guide supplies exactly that: practical checklists, governance blueprints, culture-alignment tools, synergy dashboards, and Dutch-specific legal pointers drawn from years of cross-border deals. Read on to learn how early planning, disciplined execution, and relentless tracking turn integration risk into measurable gain. Whether your deal is a small bolt-on or a transformational merger, the principles we outline will help you move forward with confidence.

Post-Merger Integration Explained: Definition, Scope, and Timeline

Post-merger integration—also called post-acquisition integration, M&A integration, or simply PMI—is the coordinated set of activities that turn two legally combined entities into one operational business. It covers everything from appointing a new leadership team and migrating IT systems to harmonising HR policies, fulfiling regulatory promises, and delivering the synergies the deal thesis was built on. In a nutshell, PMI is the execution engine that converts purchase price into lasting value.

Why does it matter? Because the odds are brutal: studies routinely show that 60-70 % of mergers fail to beat their cost of capital, and culture-related attrition can wipe out as much as half of planned synergies. Successful PMI, on the other hand, speeds up time-to-synergy, safeguards customer and employee trust, and provides the steady cash flows shareholders expect.

“How long does post merger integration take?” depends on deal complexity, but experience suggests three overlapping horizons:

- Pre-Signing / Due Diligence – Identify red flags, estimate synergies, design the integration strategy.

- Signing ➜ Closing – Secure competition clearance (ACM/EU Commission), inform Dutch works councils, prepare notarial deeds and Chamber of Commerce filings.

- Day 1 – Announce the deal, launch interim governance, maintain business continuity.

- First 30/60/100 Days – Capture quick wins, finalise org charts, integrate support functions.

- Year 1 – Deliver majority of cost synergies, complete system migrations, track culture adoption.

- Year 3 – Finish long-tail projects, measure revenue upsides, embed continuous-improvement cycles.

A mid-sized Dutch-international transaction often needs 12-18 months to reach operational “steady state,” with some IT or culture initiatives stretching toward the three-year mark.

Core Pillars of a Successful PMI

A sturdy PMI rests on seven mutually reinforcing pillars:

- Strategy Alignment – Every integration work-stream traces back to the value-creation thesis.

- Governance – Clear roles, cadence, and escalation paths steer thousands of daily decisions.

- People – Talent retention, change management, and leadership visibility keep morale high.

- Processes – Standardised, lean workflows reduce complexity and cost.

- Technology – Rationalised systems enable data integrity and scalable operations.

- Culture – Shared norms and behaviours ensure that “how we work” supports strategy.

- Legal & Compliance – From GDPR to Dutch pension law, staying onside of regulations avoids costly setbacks.

Neglect one pillar and the whole edifice wobbles; strengthen them together and synergies accrue faster.

Four Integration Styles and When to Use Them

Different deals call for different integration intensities:

| Style | What Happens | When It Works | Watch-outs |

|---|---|---|---|

| Absorption | Target fully folded into buyer; one culture, one system. | Small bolt-ons, clear superiority of buyer’s model. | Risk of talent flight if identity is erased. |

| Symbiosis | Best of both kept; joint teams design the future state. | Similar size or complementary strengths. | Decision-making can bog down without firm governance. |

| Preservation | Target remains largely autonomous; only select functions integrated. | High-growth niche brands, creative firms. | Synergies limited; cultures may drift apart. |

| Holding | Buyer owns financially, but no operational integration. | Private-equity portfolios, short-term financial plays. | Little knowledge transfer; exit may be harder. |

Choosing the right style early—and communicating it clearly—prevents unrealistic expectations and guides resource allocation throughout the integration journey.

Start Early: Preparing for Integration During Due Diligence

The biggest myth in post merger integration is that the “real work” starts after closing. In reality, every week of pre-signing silence erodes future synergies: systems diverge further, employees invent their own narratives, and competitors poach distracted customers. By weaving integration questions into commercial, financial, and legal due diligence, you bank time and surface deal-breakers while you still have contractual leverage.

What information should hit the data room? At minimum collect:

- Operational overlaps: plant capacity, logistics lanes, make-or-buy contracts

- Culture indicators: decision-making styles, engagement scores, works-council minutes

- Technology inventories: ERP versions, custom code, cybersecurity incidents

- People data: critical talent lists, retention risk, union agreements

- Contractual constraints: exclusivity clauses, change-of-control triggers, key-supplier MFNs

Armed with those insights, the deal team can draft a “Day-1 Readiness” checklist. Non-negotiables typically include:

- Interim org chart and leadership announcements

- Internal and external communication decks pre-cleared by legal and PR

- Regulatory green lights (Dutch ACM, EU Commission, sector regulators)

- Notarial deeds, Chamber of Commerce updates, and UBO filings queued for submission

- Payroll, benefits, and banking interfaces tested for uninterrupted run on the first pay cycle

Only when these items score green can management sleep the night before closing.

Setting Up a Clean Team

Competition law bars the exchange of competitively sensitive data until closing. A “clean team” solves the conundrum: it is a firewalled squad—often outside consultants and select employees—operating under strict NDAs. Their mandate:

- Analyse pricing, customer lists, and R&D pipelines to refine synergy models

- Produce aggregated, anonymised reports for the broader integration team

- Adhere to Dutch ACM and EU rules on data segregation; non-compliance can delay closing or trigger fines

Best practice is to charter the clean team 4–6 weeks before signing, give them separate IT drives, and document every data request in a log reviewed by antitrust counsel.

Drafting a 100-Day Plan

Investors expect tangible wins fast, so outline the first 100 days before signing the SPA. Start with three buckets—synergy capture, organisation design, communication—and tag each task with an owner and KPI. An illustrative timeline:

| Day | Key Activity | Owner | KPI / Gate |

|---|---|---|---|

| 1 | Joint CEO town-hall, publish FAQ | Comms Lead | 90 % employee reach |

| 15 | Harmonise travel & expense policy | HR Lead | €150k annualised savings |

| 30 | Launch cross-sell pilot to top-20 accounts | Sales Lead | €1 m pipeline created |

| 60 | Consolidate procurement of office supplies | Ops Lead | 8 % cost reduction |

| 90 | Cut over to single email domain & SSO | IT Lead | <2 % ticket escalation |

| 100 | Synergy review with Board | IMO Head | ≥40 % of Year-1 target realised |

Because the plan was sketched early, the Integration Management Office can hit “send” the moment the notary closes the deal, turning intent into momentum.

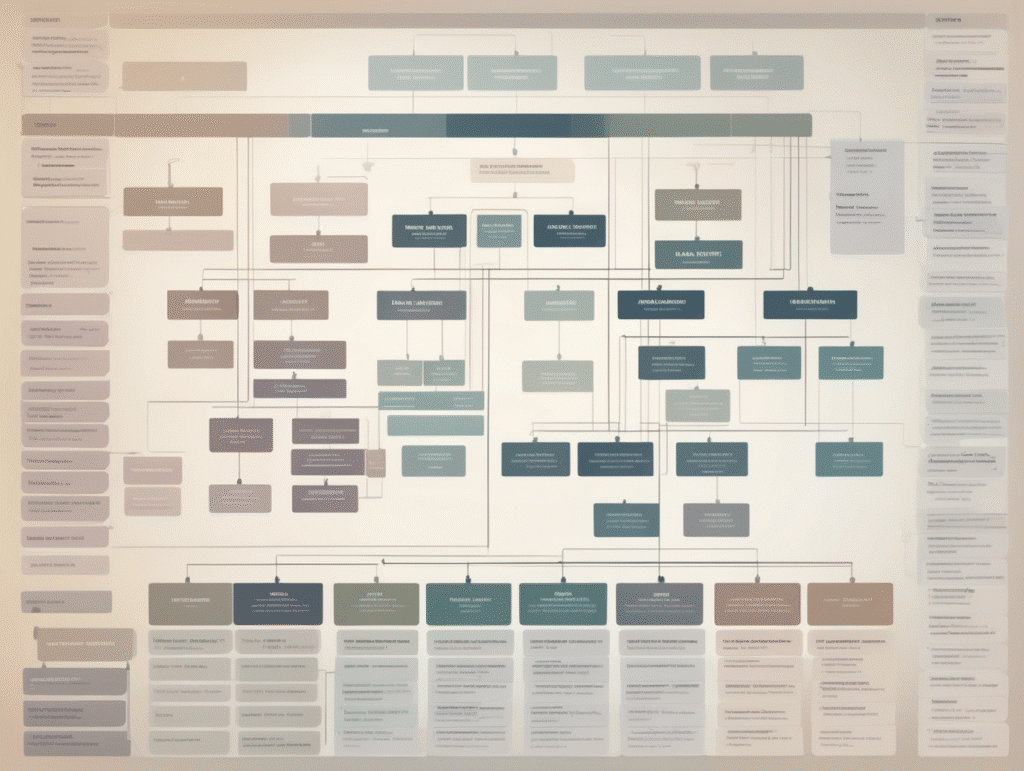

Governance and Leadership: Building an Integration Command Center

No matter how brilliant the deal thesis, post merger integration grinds to a halt without tight governance. The answer is a single “Integration Command Center”, often branded the Integration Management Office (IMO). Think of it as a war room that translates strategy into daily action, tracks synergies, and removes roadblocks before they hit the front line.

| Seat | Core Responsibility | Typical Time Commitment |

|---|---|---|

| Executive Sponsor | Sets direction, secures funding, shields team from politics | 1 day / week |

| Integration Lead (IMO Head) | Runs the command center, owns overall roadmap & KPIs | Full-time |

| Work-Stream Leads (IT, HR, Finance, Ops, Legal) | Deliver functional plans, report progress | 50-100 % |

| Board Liaison / Secretary | Preps steering decks, escalates decisions | 20 % |

| Change & Comms Lead | Crafts narratives, measures sentiment | 50 % |

Hallmarks of an effective IMO include:

- Daily “pulse” stand-ups and weekly dashboard reviews

- A live risk register ranked by impact × likelihood

- Clear hand-offs between diligence team, deal team, and operations

- Tooling that scales—shared inbox, project software, and a data lake for synergy tracking

Decision-Making & Escalation Frameworks

Integration throws up hundreds of micro-decisions. A lightweight but explicit framework keeps momentum:

- Use a simple

RACImatrix so everyone knows who is Responsible, Accountable, Consulted, and Informed. - Schedule a steering committee every two weeks; ad-hoc sessions can be called within 48 hours.

- Pre-define escalation triggers:

- Budget variance > 10 %

- Timeline slip > 4 weeks on critical path

- Loss of a “critical talent” individual

- Regulator query or compliance breach

When a trigger fires, the work-stream lead submits a one-page issue brief; the IMO head decides whether to roll it up to the executive sponsor or park it for functional resolution. That discipline prevents paralysis without drowning leaders in noise.

Stakeholder Alignment and Communications

Governance fails if the right people are not brought along. Map stakeholders early:

- Internal: employees, unions, Dutch works councils, middle management

- External: customers, suppliers, regulators (ACM, EU Commission), media, local communities

A living communication plan keeps everyone synchronised:

| Audience | Core Message | Channel | Frequency | Owner |

|---|---|---|---|---|

| All employees | “Why we merge, what changes, what stays” | Town-hall + intranet | Day 1, then monthly | CEO & Comms |

| Key customers | Continuity of service, new value | Direct call + FAQ PDF | Day 2, then quarterly | Sales Lead |

| Works council | Employment impacts, consultation timeline | Formal meeting | Pre-closing, then as needed | HR Lead |

| Regulators | Compliance status, milestone updates | Formal filings | Per statutory date | Legal Lead |

Consistent cadence, honest tone, and two-way channels turn potential anxiety into engagement—fuel the command center needs to drive the integration home.

People and Culture: Winning Hearts and Minds

Systems can be rebuilt and processes rewritten, but once trust is broken it is almost impossible to restore. Culture and people decisions therefore sit at the very center of post merger integration success. Analysts estimate that up to 70 % of failed deals trace back to employee disengagement, talent flight, or an unaddressed clash of working norms. Dutch transactions add another layer of complexity: works councils have consultation rights on re-organisation plans, collective labor agreements (CAOs) may differ, and pension schemes are highly regulated. A structured, empathetic approach to culture and people avoids legal missteps and keeps the new organisation’s “social contract” intact.

Conducting a Culture Gap Analysis

Start by making the invisible visible. A culture gap analysis compares how the two legacy firms think, decide, and behave.

- Data collection

- Pulse surveys covering decision speed, risk appetite, customer focus, hierarchy tolerance.

- Focus groups in both Dutch and English to capture nuance across locations.

- Leadership interviews probing unwritten rules and stories that shape behavior.

- Floor walks and observation, noting meeting etiquette, dress code, break habits.

- Synthesis

Convert findings into a “culture heat map” that ranks gaps from benign to mission-critical—for instance, consensus-driven vs. top-down decision styles. - Translation

Translate gaps into integration themes: shared rituals (weekly stand-ups), symbols (new logo on both sites), and behaviours (one decision matrix for project funding).

Publish the results quickly; employees are more likely to buy into change when they see their voices quantified and acted upon.

Talent Retention and Change Management

The integration team’s first KPI is “key talent in seat.” Losing scarce engineers or relationship managers undermines every synergy model.

- Identify “critical roles” and match them with named successors within 30 days.

- Offer retention bonuses tied to milestone dates (e.g., 50 % at Day 100, 50 % at Year 1). Under Dutch law, document these incentives transparently to pass works-council scrutiny.

- Deploy a “Change Champion” network—volunteers from both legacies who host Q&A circles, dispel rumors, and funnel feedback to leadership.

- Stagger announcements: confirm leadership appointments before structural changes to limit uncertainty.

- Run monthly pulse checks; a spike in voluntary-exit intent is an early-warning indicator that needs immediate executive attention.

Effective change management also hinges on storytelling. Frame the merger as an opportunity—new markets, shared innovation budget—not as a cost-cutting exercise.

Harmonizing HR Policies and Benefits

Nothing erodes goodwill faster than inequitable perks. Harmonisation should follow a transparent playbook:

- Inventory

- Employment contracts: notice periods, non-competes, collective agreements.

- Reward structures: base pay, variable pay, stock options.

- Benefits: Dutch pension schemes (defined-contribution vs. industry funds), leave allowances, mobility budgets.

- Design principles

- “Equal pay for equal work” within 12 months.

- Preserve the richer of two benefit levels where cost-neutral; otherwise, compensate via one-off transition payments.

- Comply with Dutch Pension Act by notifying participants and the pension provider of any plan merger.

- Implementation roadmap

- Works-council consultation letters → legal review → employee information sessions → individualized contract addenda.

- Digital self-service portal for employees to compare old vs. new terms.

- HR helpdesk with extended hours during the first payroll cycle.

By tackling culture gaps head-on, safeguarding key people, and aligning employment terms early, you secure the human engine that will power every other work-stream in the integration. When employees feel heard, valued, and treated fairly, operational targets and synergy numbers invariably follow.

Systems, Processes, and Operational Integration

After people, nothing drives or derails post merger integration faster than the everyday machinery of the business—systems that book orders, processes that ship products, and routines that keep customers happy. If culture is the heart, operations are the circulatory system: invisible when healthy, life-threatening when clogged. The goal is to merge workflows at a pace that captures synergies without interrupting cash generation. That generally means a phased, risk-managed schedule: stabilise, standardise, optimise.

A common playbook looks like this:

- Stabilise (Day 1–30) – Freeze non-critical changes, issue interim process maps, stand up a joint help desk.

- Standardise (Day 30–180) – Select lead systems, harmonise master data, align approval limits, begin phased cut-overs by geography or business line.

- Optimise (Month 6–24) – Retire duplicate apps, re-engineer supply-chain routes, roll out advanced analytics, and renegotiate vendor contracts at combined scale.

Throughout, keep customer-facing and revenue systems in the last migration wave unless there is a burning risk. That sequencing protects the top line while backend synergies accrue.

Technology Stack Rationalization

A messy IT landscape soaks up integration budget and breeds user frustration. Start with a full inventory—hardware, software, licenses, APIs—and tag each item with cost, criticality, and contractual lock-ins. Then apply a simple decision grid:

| Criteria | Keep | Replace | Integrate |

|---|---|---|---|

| Annual cost < €50 k & unique feature | ✅ | — | — |

| Redundant functionality, low user NPS | — | ✅ | — |

| Mission-critical, both sides rely on | — | — | 🤝 |

Next steps:

- Spin up a data-migration factory that cleanses, deduplicates, and maps master data before any system cut-over.

- Enforce cybersecurity by design: multi-factor authentication, zero-trust network zones, and red-team testing two weeks before go-live.

- Validate GDPR compliance for every data flow—especially if HR or customer files will cross EU borders. Log processing activities in the joint Article 30 register.

- Document all changes in a service catalogue so that post-integration support doesn’t rely on tribal knowledge.

A controlled pilot—e.g., migrating the Benelux sales team to one CRM—lets you debug scripts and change-management tactics before global rollout.

Finance & Reporting Consolidation

Financial integration underpins everything from covenant compliance to synergy verification. Anchor the work in three streams:

- Chart of accounts (CoA) – Map both ledgers to a unified CoA; aim for 80 % match by Day 60 so that management can view consolidated flash results.

- ERP convergence – If both firms run on SAP, decide which instance wins; if not, consider a greenfield cloud ERP to avoid endless customisation. Time the switch at quarter-end to simplify reconciliations.

- Reporting standards – Determine whether the new group reports under IFRS or Dutch GAAP; build automated conversion bridges where local entities must retain a statutory ledger.

Quick win: centralise treasury and cash pooling within 30 days to unlock working-capital synergies and improve FX visibility.

Legal & Compliance Alignment

Operational moves trigger legal obligations that, if missed, can grind the deal to a halt:

- Entity consolidation – Draft notarial deeds for mergers or cross-border conversions; file changes with the Netherlands Chamber of Commerce within eight days.

- Contract novation – Review customer and supplier agreements for change-of-control clauses; send consent letters well before system cut-over.

- Intellectual property transfer – Record trademark assignments with the Benelux Office for Intellectual Property and update licence metadata in the IP management system.

- Regulatory filings – Submit final remedy reports to the ACM or European Commission as conditions precedent are satisfied; log correspondence in the IMO’s compliance tracker.

- UBO registration – Update ultimate beneficial owner details for every Dutch entity within the statutory two-month window.

Treat each compliance milestone as a hard gate in the project plan—no system or process goes live without the legal green light. That discipline protects the integration from fines, reputational hits, and last-minute reversals, allowing the combined company to focus on value creation instead of damage control.

Synergy Capture and Performance Tracking

Synergies are the tangible proof that the integration is working. They come in three main flavors—cost, revenue, and working-capital benefits—each of which must be measured against a clearly defined baseline. Without a rigorous tracking system, promised value slips through the cracks, steering committees lose credibility, and the post merger integration narrative turns negative with investors. A lightweight but disciplined dashboard, updated weekly, keeps everyone honest and allows early course-corrections.

A practical synergy dashboard might resemble the table below, shared in the Integration Management Office’s (IMO) cloud folder and reviewed during every steering call:

| Category | Baseline (€ m) | Stretch (€ m) | YTD Realized | Forecast Year-End | Owner |

|---|---|---|---|---|---|

| Procurement savings | 8.0 | 10.0 | 3.2 | 8.5 | Ops Lead |

| Headcount efficiency | 5.5 | 6.0 | 2.0 | 5.4 | HR Lead |

| Cross-sell revenue | 4.0 | 7.0 | 0.9 | 4.8 | Sales Lead |

| Working-capital release | 2.5 | 3.5 | 1.1 | 2.7 | Finance Lead |

Setting SMART KPIs and Milestones

KPIs only drive behavior when they are SMART—Specific, Measurable, Achievable, Relevant, and Time-bound.

- Specific: “Reduce combined indirect spend by 8 %” beats “optimise procurement.”

- Measurable: Track savings against the audited 12-month pre-deal baseline.

- Achievable: Align targets with integration style—an Absorption deal yields quicker cost wins than a Preservation play.

- Relevant: Metrics must link to the deal thesis, not pet projects.

- Time-bound: Anchor each KPI to Day 30, Day 100, Year 1, and Year 3 gates.

Quick win milestones often include:

- Day 30: Single vendor master file live.

- Day 60: First cross-sell offer mailed to top-50 customers.

- Day 100: Achieve ≥40 % of Year-1 synergy plan.

Tie variable compensation for work-stream leads to these checkpoints to hard-wire accountability.

Continuous Improvement and Value Uplift

Synergy hunting does not end once the dashboard turns green. Adopt an agile rhythm:

- Run quarterly “value sprints” that revisit assumptions, identify new levers, and reprioritise initiatives.

- Hold post-integration retrospectives; capture lessons learned and update the PMI playbook for future deals.

- Feed actual performance back into budgeting and strategy cycles, ensuring that synergy gains stick long after the integration team disbands.

By embedding continuous improvement, the combined company shifts from one-off savings to a culture of ongoing value creation—securing the long-term return on its merger investment.

Pitfalls and Red Flags to Avoid

Even a textbook integration plan can unravel if management overlooks a handful of classic traps. The most frequent missteps are cultural arrogance, over-engineering the IT landscape, fuzzy governance, and ignoring Dutch legal nuances such as works-council consent. Each error snowballs: culture clashes trigger talent flight, which delays system cut-over, which inflates cost and erodes the very synergies that justified the post merger integration in the first place. Staying alert to early warning signs—and reacting fast—keeps the deal thesis intact.

Early Warning Indicators

- Voluntary employee turnover spikes above industry benchmark for two consecutive months

- Customer NPS or order volume drops >5 % in any key segment

- Integration budget variance exceeds 10 % or timeline slips more than four weeks

- Regulatory questions from ACM or EU Commission remain open past the stated deadline

- Duplicate systems proliferate because the “keep vs. kill” decision stalls at steering level

- Steering meetings shift from weekly to ad-hoc, signalling governance fatigue

Rapid Response Playbook

- Assemble a cross-functional “SWAT” squad within 24 hours; give it direct access to the Integration Management Office.

- Re-establish a daily stand-up to triage issues and assign single owners.

- Freeze discretionary projects and redirect resources to critical-path activities (e.g., payroll, customer interfaces).

- Launch a targeted communication burst—FAQs, video updates, manager toolkits—to reset employee and customer confidence.

- Engage external counsel if legal or regulatory deadlines are at risk; file for extensions proactively.

- Present a revised milestone chart to the executive sponsor within seven days, securing fresh sign-off and budget where needed.

Executing this playbook quickly converts red flags into manageable tasks, allowing the post merger integration journey to regain momentum without permanent value loss.

Checklists, Frameworks, and Templates You Can Apply Immediately

Cut the theory and start ticking boxes. Below is a starter-kit you can copy into Excel, Notion, or your favorite PM tool this afternoon.

PMI Readiness – 10-Point Checklist

- Synergy model signed off and baselined

- Integration governance (IMO, RACI, cadence) formalised

- Day-1 communication packs approved by Legal & Comms

- Clean-team protocols filed with antitrust counsel

- Interim org chart and retention offers drafted

- Single source of master data identified

- TSA (if any) scoped and costed

- Works-council consultation scheduled

- Legal entity structure mapped, notarial deeds pre-drafted

- Integration budget and KPI dashboard live

100-Day Plan – Skeleton Timeline

| Week | Focus | Sample Deliverable |

|---|---|---|

| 1 | Stabilise | Joint town-hall & FAQ |

| 3 | Quick wins | Consolidated travel policy |

| 6 | Synergy sprint | Procurement RFP launched |

| 10 | Systems | CRM pilot cut-over |

| 14 | Review | Board gate with KPI heat map |

Synergy-Tracking Sheet (columns)

Category | Owner | Baseline € | Target € | Realised € | % Achieved | Comment

Communication Cascade Calendar

Day 1 employees / Day 2 key customers / Day 5 suppliers / Weekly pulse updates.

Upskill Options

- CIMA “PMI Certificate” (online, 12 hrs)

- Alex van Groningen Post-Merger Integration course (Amsterdam, quarterly)

- BCG & Deloitte whitepapers for advanced playbooks

How to Tailor Tools for Different Deal Sizes

For a bolt-on, shrink the checklist to the top five risks, run a 60-day plan, and track synergies quarterly. For a transformational merger, expand work-streams, add weekly steering decks, and separate cost-vs-growth dashboards to keep leadership focus sharp.

Moving Forward with Confidence

Early integration planning during due diligence, a clear command-center governance model, and an uncompromising focus on people lay the groundwork for success. Add disciplined execution—sequenced system cut-overs, culture rituals anchored in data, and SMART synergy targets—and you move from value protection to value creation. Finally, continuous measurement and periodic “value sprints” keep the merged company responsive long after the Integration Management Office switches off the lights.

If your next step is closing a Dutch or cross-border deal, legal certainty is just as critical as operational finesse. Our team at Law & More can handle the due-diligence deep dive, prepare ACM filings, draft notarial deeds, and monitor post-merger compliance so your leadership can focus on hitting those synergy dashboards. Reach out for a confidential conversation and start your post-merger integration journey with the right partners in place.