When a reintegration process goes wrong under Dutch law, one question comes up immediately: who foots the bill? In almost every case, the primary financial and legal risk lands squarely on the employer’s shoulders. Getting this wrong can lead to a hefty wage sanction from the UWV, forcing you to pay an employee’s salary for a third year, or even a court-ordered fair compensation payment if your actions are judged to be seriously negligent.

Defining the Financial Stakes of Reintegration Failure

When an employee is on long-term sick leave, the Dutch legal system doesn’t just suggest—it demands—that the employer actively helps them get back to work. This isn’t just a courtesy; it’s a mandatory, step-by-step journey laid out in the Wet verbetering poortwachter (Gatekeeper Improvement Act).

This Act is the foundation of the entire reintegration process, and it clearly spells out what’s expected from both sides. Knowing this framework inside and out is crucial, because failing to follow it has immediate and expensive consequences. The key question isn’t about placing personal blame, but about procedural and financial liability. If the Employee Insurance Agency (UWV) looks at the file and decides the employer’s efforts were lacking, the penalties are designed to sting.

Core Employer Responsibilities

The law is clear: the employer must take the lead. This means doing a lot more than just waiting for a recovery. The UWV’s assessment will hinge on how well you’ve handled these key responsibilities:

- Driving the Process: You must initiate and manage the reintegration plan right from the first week of sickness.

- Following Expert Advice: This means hiring a company doctor (bedrijfsarts) and other necessary specialists, and—critically—following their advice diligently.

- Keeping Meticulous Records: You are required to maintain a detailed reintegration file (re-integratieverslag) that documents every single action, meeting, and decision over the two-year period.

- Exploring Every Avenue: You have to genuinely investigate all feasible return-to-work options. First, in the employee’s original role; then, in another role within your company; and finally, if necessary, at another company (this is known as ‘spoor 2‘ or ‘second track’ reintegration).

The Financial Consequences of Inaction

When these duties are neglected, a procedural oversight quickly becomes a massive financial problem. The two biggest risks are:

- UWV Wage Sanction (Loonsanctie): If, after two years, the UWV concludes your efforts fell short, it can impose a sanction that forces you to continue paying the employee’s salary for up to 52 extra weeks. This effectively stretches the sick pay period from two years to three.

- Fair Compensation (Billijke Vergoeding): In more extreme cases where an employer’s conduct is deemed seriously culpable, the employee can take the case to court. A judge can then award fair compensation, which is a separate penalty that comes on top of any UWV sanction.

Don’t mistake the Wet verbetering poortwachter for simple administrative red tape. It’s a legal framework with real teeth, designed to ensure employers are held accountable for their role in the process. Dropping the ball here is one of the most expensive mistakes a Dutch business can make.

To put these risks into perspective, let’s break down the main penalties employers face when the UWV finds their reintegration efforts insufficient.

Key Risks for Employers in Failed Reintegration

| Risk Category | Description | Potential Financial Impact |

|---|---|---|

| UWV Wage Sanction | The UWV extends the employer’s obligation to pay the employee’s salary for up to 52 weeks beyond the standard two-year period due to insufficient reintegration efforts. | An entire extra year of salary costs (typically 70% or more of the employee’s gross wage), plus associated employer costs. |

| Fair Compensation | A separate, court-awarded penalty if an employer’s actions are deemed ‘seriously culpable’. This goes beyond procedural errors and points to significant neglect or improper conduct. | Can range from thousands to tens of thousands of euros, awarded by a judge on top of the wage sanction and any transitional payment. |

| Legal & Advisory Costs | The costs associated with disputing a UWV decision or defending against a court claim. This includes legal fees for lawyers and advisory fees for reintegration specialists. | Substantial, regardless of the outcome. These costs add up quickly during protracted disputes. |

| Reputational Damage | A public finding of insufficient care can harm an employer’s reputation, making it harder to attract and retain talent. | Hard to quantify but can have long-term negative effects on company culture and recruitment efforts. |

As the table shows, the financial fallout from a failed reintegration isn’t just about one penalty. It’s a cascade of potential costs that can put significant strain on any business. That’s why getting the process right from day one is not just a matter of compliance, but of sound financial management.

Navigating the Dutch Reintegration Framework

The entire Dutch approach to long-term employee sickness is built on a single, crucial piece of legislation: the Wet verbetering poortwachter (Gatekeeper Improvement Act). You can’t think of this as a loose set of guidelines; it’s a mandatory project plan with a strict timeline. The law is designed to forge a collaborative effort between the employer and the employee from the very first day of sick leave.

Its sole purpose? To ensure every possible step is taken to get the employee back to work in a timely and sustainable way. Understanding this highly structured process is vital because it’s precisely why the legal and financial burden falls so squarely on the employer’s shoulders. The law doesn’t just hope for the best—it assigns clear roles, effectively turning the employer into the project manager of the employee’s recovery journey.

The Employer as the Process Driver

Under the Gatekeeper Improvement Act, the employer is legally required to take the lead. This isn’t a passive role. It’s an active one that involves facilitating, funding, and documenting the entire two-year process. The key milestones aren’t suggestions; they are hard deadlines that you must meet and record meticulously in the employee’s reintegration file.

Think of the process as a series of mandatory checkpoints:

- Week 6: A company doctor (bedrijfsarts) must have completed a Problem Analysis (Probleemanalyse). This report outlines the employee’s functional limitations and what they are still capable of doing.

- Week 8: Using that analysis, the employer and employee must jointly create a formal Plan of Action (Plan van Aanpak). This is the roadmap, detailing the specific steps and goals for reintegration.

- Regular Evaluations: This isn’t a “set it and forget it” plan. It must be evaluated regularly (at least every six weeks) and adjusted based on the employee’s progress or setbacks.

Your duty as the employer is to clear any hurdles in the way. This could mean anything from adapting the workplace and arranging mediation if a conflict arises, to exploring entirely different roles within the company. Every action, every conversation, and every decision must be documented. This file is your primary evidence that you’ve fulfilled your obligations. For a more detailed look into your duties during this period, you can read our guide on Dutch sickness benefits.

The Employee’s Duty to Cooperate

While you’re driving the process, the employee has a clear legal duty to get on board and participate constructively. It’s very much a two-way street. An employee cannot, for instance, unreasonably refuse suitable work, skip appointments with the company doctor, or otherwise block the efforts laid out in the Plan of Action.

Their role is one of active cooperation. This means providing the company doctor (not you, the employer) with the necessary medical information, showing up to scheduled meetings, and genuinely trying to follow the agreed-upon steps to return to work. An employee who fails to cooperate can face serious consequences, which we’ll get into later.

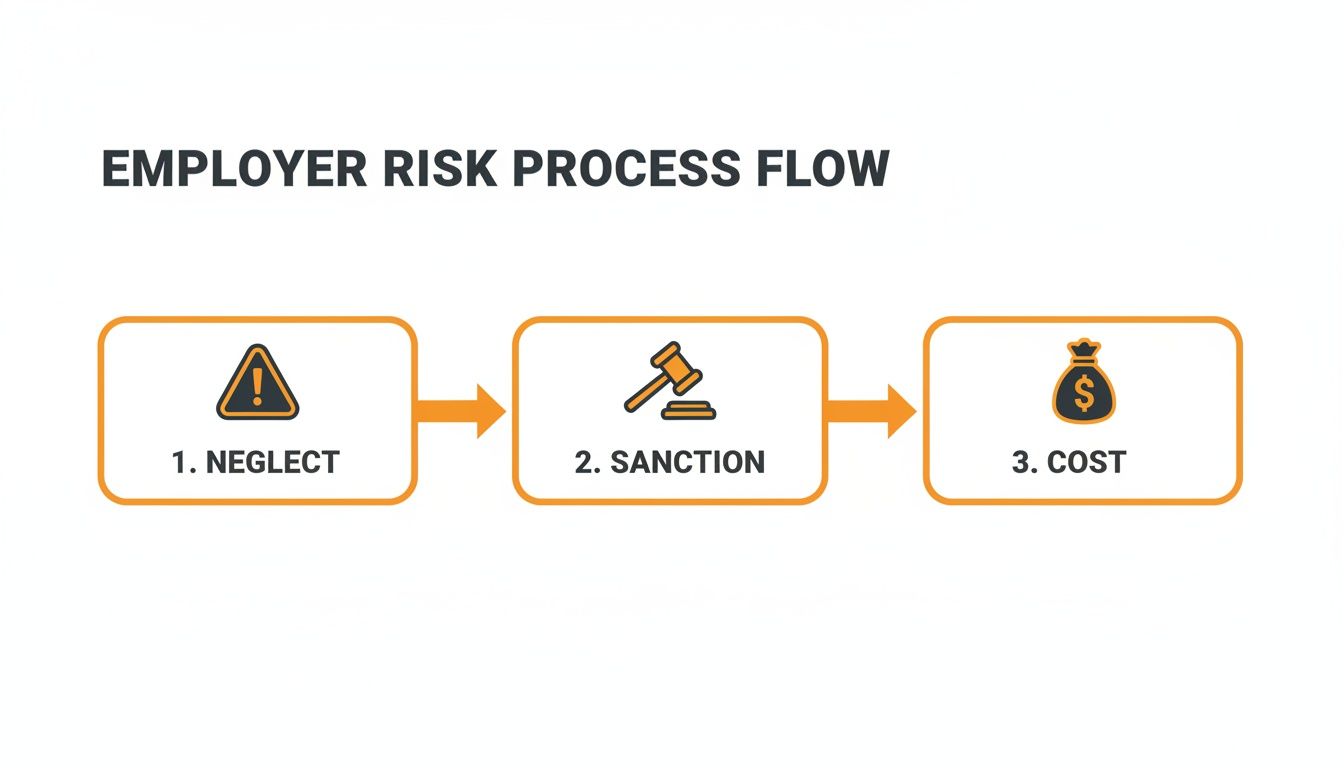

This process flow shows the direct line from an employer’s neglect to significant financial penalties.

The visual makes a critical point crystal clear: neglecting your duties directly triggers sanctions, turning a simple procedural mistake into a substantial financial blow. In the Netherlands, when employers don’t meet their reintegration obligations, they face severe financial risks. The most common is a wage sanction that extends your legal duty to pay their salary for an additional year.

The Employee Insurance Agency (UWV) enforces this strictly. If they find you’ve been negligent, you’ll be ordered to continue paying the employee’s wages for 52 extra weeks on top of the standard 104-week period. This legal structure is what cements the employer’s risk when reintegration fails.

How the UWV Judges Your Reintegration Efforts

As an employee’s two-year sick leave anniversary draws near, the Employee Insurance Agency (UWV) enters the picture, acting as the final referee. At this critical juncture, you’ll submit the complete reintegration file (re-integratieverslag), and you can be sure the UWV will scrutinise every single action you’ve taken. This is far from a simple box-ticking exercise.

The entire assessment boils down to one core question: did the employer do enough? They are looking for hard evidence of consistent, timely, and meaningful action across the entire 24-month period. A well-documented file that shows proactive engagement is your strongest defence against a penalty.

From Paperwork to Penalties: The Loonsanctie

When the UWV concludes an employer’s efforts were insufficient, it can impose a loonsanctie (wage sanction). This isn’t a fine you pay to the government; it’s a direct order forcing you to continue paying the employee’s salary for up to another 52 weeks.

This penalty effectively stretches the sick pay period from 104 weeks to a potential 156 weeks, transforming a procedural mistake into a massive financial liability. The logic here is that if the employer had done more, the employee might have returned to work sooner, avoiding a burden on the social security system.

The UWV sees the loonsanctie as a corrective measure. It’s not meant to be punitive but to compel the employer to fix their reintegration shortcomings and complete the process properly—all while continuing to foot the wage bill.

And this sanction is far from rare. Recent data from the Employee Insurance Agency (UWV) reveals that in 2023 alone, it imposed 6,200 wage sanctions on Dutch employers. With a staggering 70% of these decisions being upheld after review, the average financial penalty per case reached approximately €60,000 as the mandatory 104-week payment period was extended by another year.

Common Triggers for a Wage Sanction

The UWV has a sharp eye for specific red flags that signal an employer hasn’t met their obligations. These aren’t just minor administrative slips; they’re fundamental failures in managing the process.

Common reasons for a loonsanctie include:

- Ignoring Medical Advice: One of the most serious errors you can make is failing to follow or properly implement the recommendations of the company doctor (bedrijfsarts).

- Delaying Second Track Reintegration: Once it’s clear an employee can’t return to your company, you must promptly and actively start the search for suitable external work (spoor 2). Unjustified delays are a primary cause of sanctions.

- Insufficient Job Search Support: Just telling an employee to look for another job won’t cut it. The UWV expects tangible support, like hiring a specialised reintegration agency or providing coaching.

- Inadequate Documentation: A poorly maintained or incomplete reintegration file implies a lack of organised effort. If you can’t prove you took an action, the UWV will simply assume you didn’t.

When Neglect Leads to a Double Penalty

A wage sanction from the UWV is a serious financial hit, but it’s not the only risk an employer runs when reintegration efforts go wrong. If an employer’s neglect is particularly severe, they can be hit with a second, often more unpredictable, financial penalty. This is what we call the double penalty.

This happens when an employer doesn’t just get a loonsanctie for failing their procedural duties but is also taken to court by the employee for seriously culpable conduct. The result? A court can award a separate billijke vergoeding (fair compensation) right on top of the wage sanction. This turns one mismanaged case into a doubly expensive headache, showing just how vital it is to handle every step of the process with care.

What Constitutes Seriously Culpable Conduct?

A wage sanction is usually about procedural missteps. Fair compensation, on the other hand, is reserved for situations where an employer’s behaviour has been exceptionally poor. Dutch courts don’t award this lightly; it requires a level of neglect that actively sabotages the employee’s chances of recovery or finding new work.

Judges are looking for a pattern of behaviour that goes well beyond simple mistakes. Things like consistently ignoring the advice of the company doctor, refusing to arrange a second-track reintegration pathway out of unwillingness rather than oversight, or creating a hostile environment that makes the employee’s condition worse are all actions that could cross this line.

A key distinction is intent versus incompetence. While a UWV sanction can result from disorganisation, a court-awarded fair compensation often points to an employer’s deliberate inaction or gross negligence in fulfilling their fundamental duty of care.

The Court’s Perspective in Recent Rulings

Recent case law gives us a clear picture of what kind of employer actions lead to these significant awards. Courts meticulously analyse the entire two-year timeline, searching for evidence that the employer’s actions—or lack thereof—were the primary reason the reintegration failed.

Common scenarios that attract judicial scrutiny include:

- Refusing reasonable workplace adjustments: If a company doctor suggests specific changes (like different hours or altered duties) and the employer refuses without a very good business reason, that’s a major red flag.

- Creating an unsolvable conflict: When an employer allows a workplace conflict to fester, or even contributes to it, making it impossible for the employee to return, they may be found culpable.

- Pressuring an employee to resign: Any attempt to coerce a sick employee into terminating their contract simply to avoid reintegration duties is considered extremely serious misconduct.

These rulings make it clear that when reintegration falls apart, judges ask one simple question: why? If the answer points to a lack of genuine effort or bad faith from the employer, the financial fallout can be severe. The size of the fair compensation award depends on the specific circumstances, including the employee’s financial losses and just how badly the employer behaved. You can learn more about the specifics of fair compensation in our article on employment termination payments.

The Financial Double-Hit Explained

Picture this: an employer ignores their company doctor’s advice and fails to start a second track process on time. First, the UWV imposes a wage sanction, forcing them to pay the employee’s salary for a third year. The employee then takes the case to court, arguing that the employer’s deliberate inaction destroyed any chance of them finding a new job, leading to long-term unemployment.

The court agrees, finding the employer’s conduct seriously culpable. It then awards the employee a billijke vergoeding of €40,000 to compensate for the damage done. The employer is now paying for both the procedural failure (the wage sanction) and the serious misconduct (the fair compensation). The total cost of their neglect is now far greater than either penalty would have been alone, perfectly illustrating the high-stakes risk of getting reintegration wrong.

Understanding the Employee’s Obligations and Risks

While employers are certainly in the driver’s seat for the reintegration process and carry the main financial weight, this journey is very much a partnership. Dutch law sees reintegration as a two-way street, which means employees have their own legally binding obligations. When an employee fails to cooperate, they can introduce a whole new set of risks, changing the entire dynamic of who is responsible if things go wrong.

An employee can’t simply sit back and refuse to engage. They have a clear duty to actively participate in their own recovery and return to work. This isn’t just a suggestion; it’s a legal requirement. It means showing up for scheduled appointments with the company doctor, helping to shape a realistic Plan of Action, and accepting suitable work when it’s offered.

The Employer’s Tool: Wage Suspension

When an employee starts obstructing the process without a good reason, the employer isn’t left empty-handed. The most direct tool at their disposal is the right to suspend salary payments (loondoorbetaling). This is a serious step, and it must be handled with absolute procedural precision to hold up legally.

An employer can suspend wages if an employee:

- Refuses to follow reasonable instructions.

- Skips appointments with the company doctor without a valid excuse.

- Rejects a fair offer of suitable alternative work.

- Actively hinders or delays their own recovery.

Before hitting pause on an employee’s salary, the employer is required to issue a clear, written warning. This notice has to spell out the specific reason for the intended suspension and give the employee a chance to get back on track with their obligations. Only after this formal warning has been sent can the salary payment be lawfully stopped.

A wage suspension isn’t a punishment; it’s a corrective measure. Its sole purpose is to encourage the employee to re-engage with the reintegration process. The moment the employee starts cooperating again, their salary must be reinstated, including full back pay for the suspension period.

The Ultimate Consequence: Dismissal

If an employee persistently and unreasonably blocks every attempt at reintegration, the consequences can become much more severe. Continuous non-cooperation, especially after a formal wage suspension has been tried, can ultimately create grounds for dismissal. At this point, an employer can petition the court to terminate the employment contract based on the employee’s culpable conduct.

This is a last-resort option. It requires a meticulously documented file proving the employee’s repeated and unreasonable refusal to cooperate. The employer must be able to show that they’ve done everything in their power to make reintegration work, only to be met with constant obstruction. For more information on your specific duties and rights, check our detailed article on employee sickness rights in the Netherlands.

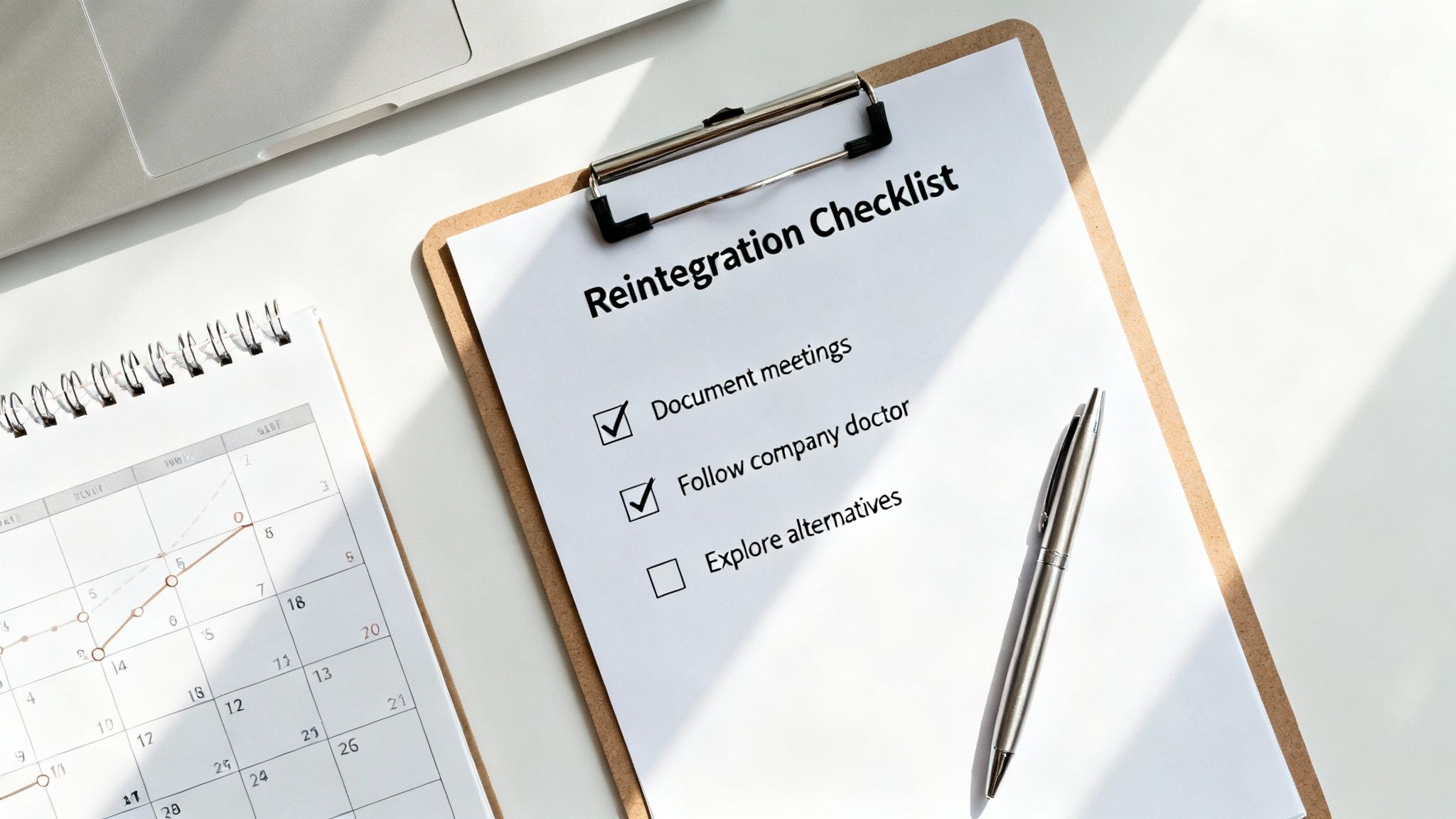

A Proactive Checklist to Minimise Reintegration Risks

Knowing the risks is one thing, but actively preventing them is a whole different ball game. To shift from problems to solutions, this checklist offers a clear, structured way to manage the reintegration process. Think of it this way: prevention and best practices are your strongest defence against financial penalties.

The goal here isn’t just about ticking boxes for compliance. It’s about building a clear, defensible record of your genuine efforts, which protects your business and helps steer the situation toward a more constructive outcome.

Maintain a Meticulous and Up-to-Date File

Your reintegration file (re-integratieverslag) is your single most important piece of evidence. This needs to be a living document, not something hastily thrown together just before the UWV review. Treat it as the definitive, chronological story of the entire two-year process.

- Document Everything: Every meeting, phone call, email, and decision must be recorded with dates, who was involved, and what was decided.

- Include All Reports: Make sure every report from the company doctor, occupational expert, or second-track agency is filed immediately as it comes in.

- Track Key Milestones: Use a timeline to keep an eye on crucial deadlines, like the six-week problem analysis and the eight-week Plan of Action.

Diligently Follow the Company Doctor’s Advice

Ignoring or cherry-picking advice from the company doctor (bedrijfsarts) is one of the fastest ways to get hit with a wage sanction. The UWV views their expert opinion as the primary guide for what is medically possible for the employee.

If you disagree with the advice, you need a compelling, well-documented reason. Don’t just ignore it. If you believe the advice is unworkable, the correct step is to request a second opinion or an expert judgment (deskundigenoordeel) from the UWV to resolve the disagreement proactively.

Genuinely Explore All Work Options

Your duty is to explore every reasonable path for the employee’s return to work. This can’t be a token effort; your exploration must be sincere and thoroughly documented to show you’re truly committed to the process.

The UWV will want to see that you have systematically investigated the following options, in this specific order:

- The Employee’s Original Role: Can their tasks or hours be adapted to fit their capabilities?

- Another Role Within Your Company: Is there any other suitable work available internally?

- External Opportunities (‘Spoor 2’): If internal options are completely exhausted, you must promptly bring in a specialised agency to help the employee find work elsewhere.

Maintain Respectful and Consistent Communication

A breakdown in communication can poison the entire reintegration process, often sparking conflicts that bring everything to a halt. It’s crucial to maintain a professional, empathetic, and consistent dialogue with your employee throughout.

A respectful process not only fulfils your duty of care but also significantly reduces the likelihood of disputes escalating into legal challenges. Even when delivering difficult news, like the need to start a second-track process, the tone and clarity of your communication are paramount.

The financial fallout from getting this wrong is significant. According to recent data from the Employee Insurance Agency (UWV), 12% of illness cases that extend beyond the standard two-year period result in employer sanctions. These penalties cost Dutch businesses a staggering €280 million in 2023 alone—a sharp 25% increase since 2020. You can learn more from the research into these post-COVID labour market challenges.

Know When to Seek Specialised Legal Advice

Finally, don’t wait for a small problem to grow into a full-blown crisis. If you find yourself in a complex situation—a conflict with the employee, a serious disagreement with the company doctor, or uncertainty about when to start ‘spoor 2’—get specialised legal advice early on.

An employment lawyer can help you navigate these tricky situations, ensure your actions are compliant, and stop a manageable issue from turning into a very costly sanction.

Frequently Asked Questions

When you’re deep in the weeds of a reintegration process, especially one that’s hit a few bumps, specific questions always pop up. Things can get complicated, fast. Here are some clear, straightforward answers to the tricky situations we see most often, helping you navigate these challenges with more confidence.

What Happens if a Conflict Blocks Reintegration?

If a conflict between you and your employee is the real reason reintegration has ground to a halt, the burden is on you, the employer, to sort it out. You can’t just throw your hands up and say the process is blocked. You have to show that you’ve actively tried to resolve the underlying issue.

When the UWV reviews the case, they will look very closely at how the conflict was handled. Letting a dispute fester or simply ignoring it is often seen as a failure to meet your reintegration duties in itself.

The best way to prove you’ve done your part is to offer a solution, like mediation. Make sure you document this offer—and the employee’s response. This paper trail is crucial evidence that you tried to clear the roadblock and can be what saves you from a hefty wage sanction.

Do Dutch Rules Apply if My Employee Works Abroad?

Yes, they almost always do. If you are a Dutch company, you are bound by Dutch employment law and its strict reintegration rules, even if your employee is stationed abroad. An employer’s legal duty of care doesn’t stop at the border. While it certainly creates some administrative headaches, your core obligations are exactly the same.

You are expected to manage a fully compliant process right from the Netherlands. This usually means coordinating with local doctors in the employee’s country of residence and then having their medical reports reviewed and validated by your own Dutch company doctor (bedrijfsarts). Using the employee’s location as an excuse for inaction is a surefire way to get sanctioned by the UWV.

When Is Second Track Reintegration Mandatory?

Second track (‘spoor 2’) reintegration is the formal process of finding your employee a suitable job outside your company. It becomes mandatory the moment it’s clear that a sustainable return to work within your organisation just isn’t going to happen. This could be because their old role is unsuitable and there are no other permanent, fitting positions available internally.

The clock is ticking here. The ‘spoor 2’ process has to start no later than one year into the sickness period. Often, it needs to start even sooner if the company doctor advises it. Delaying the start of ‘spoor 2’ is one of the most common and costly mistakes employers make, and it almost always leads to a wage sanction from the UWV.

What if a Sick Employee Resigns?

If an employee who is on sick leave chooses to resign, your reintegration obligations end on the day their contract is officially terminated. From that moment on, you are no longer responsible for managing their return to work or for paying their salary.

But be very careful. The resignation must be 100% voluntary. An employer must never pressure a sick employee to resign as a shortcut to get out of their reintegration duties. Doing so is a serious misstep and would almost certainly be classified as seriously culpable conduct. This could expose you to a court claim for fair compensation (billijke vergoeding), on top of any other lingering issues.

Navigating the complexities of Dutch employment law requires expertise and foresight. At Law & More, we provide clear, practical legal advice to help you manage reintegration challenges effectively, minimising your risks and ensuring full compliance. Protect your business by partnering with a team that understands every nuance of the process. For expert guidance on your specific case, visit https://lawandmore.eu.