Trying to trade internationally in 2025 can feel like walking through a minefield. With sanctions against Russia, Iran, and China constantly shifting, what used to be a simple legal checkbox is now a core part of business survival. The real challenge is getting your head around the different, and sometimes overlapping, restrictions set by major global powers.

The Shifting Landscape of Global Sanctions in 2025

Today’s global economy is heavily influenced by geopolitical tensions, and sanctions have become the go-to tool for foreign policy. For any company doing business across borders, especially one based in the EU, these measures are impossible to ignore. The sanctions regimes targeting Russia, Iran, and China aren’t a one-size-fits-all problem; each comes with its own reasons, targets, and compliance headaches.

You can think of it as trying to navigate three very different cities, each with its own unique traffic laws. The rules for Russia are like a city-wide lockdown on specific zones, such as finance and energy. Iran’s are like unmarked one-way streets that can easily trap foreign drivers through secondary sanctions. China’s rules are more like targeted roadblocks around specific government-linked entities. Ignoring any of them can lead to a serious crash.

Primary Sanctioning Bodies and Their Reach

The two main players setting these rules are the European Union and the United States, via its Office of Foreign Assets Control (OFAC). As a business operating in the Netherlands, you are legally required to follow all EU sanctions. But the long arm of US sanctions means you can’t afford to ignore them either, especially if you have any international connections.

- European Union (EU): EU regulations apply directly across all member states, including the Netherlands. These sanctions typically involve asset freezes, trade embargoes on certain goods, and financial restrictions.

- US Office of Foreign Assets Control (OFAC): OFAC is known for its powerful "extraterritorial" sanctions. This means a Dutch company could be penalised for a transaction with no direct link to the US, particularly if it involves US dollars or touches the American financial system in any way.

This dual-enforcement system has created a tricky landscape. To stay safe, companies often have to follow the strictest possible interpretation of the rules. The sanctions related to Russia and the Commonwealth of Independent States (CIS) are particularly fast-moving and require specialist legal knowledge. You can find out more about the complexities of this region at our dedicated Eurasia and CIS Desk.

Sanctions compliance is no longer just a legal task—it’s a strategic necessity. One mistake can lead to crippling fines, damage your reputation beyond repair, and cut off your access to key markets. Being proactive is the only real defence.

Ultimately, you need a proactive strategy for sanctions 2025: what businesses must know about doing business with Russia, Iran and China. This guide will be your map, helping you understand these complex rules and giving you a clear path to protect your business operations from risk.

Understanding the Russia Sanctions Regime

The sanctions levelled against Russia are some of the most complex and far-reaching in the world, largely driven by the ongoing conflict in Ukraine. For any business operating in the Netherlands, these aren't just abstract political manoeuvres; they represent very real operational risks that demand constant vigilance. To truly get a handle on them, you have to look past the headlines and see how these rules function on the ground.

Think of the Russian economy as a complex machine. Rather than trying to smash the entire thing, sanctions are designed to remove or jam critical components—specifically in finance, energy, and technology. This targeted approach creates a tricky landscape where some business is still possible, but other activities are strictly off-limits. Navigating this requires precision.

At the heart of the regime are several distinct types of restrictions, all designed to work in concert to apply sustained pressure.

Key Pillars of the Russia Sanctions

These restrictions aren't just one big wall; they're a series of overlapping layers that impact different sectors of the economy and specific individuals in different ways.

- Asset Freezes: This is perhaps the most direct tool. Individuals and companies deemed to be supporting the conflict or undermining Ukraine's sovereignty are put on a list. Once listed, any assets they hold within the EU must be frozen immediately. It becomes illegal to provide them with funds or economic resources of any kind, whether directly or indirectly.

- Sectoral Sanctions: These measures take aim at entire industries. For example, major Russian state-owned banks are effectively locked out of EU capital markets, crippling their ability to raise money. The energy sector faces similar constraints, with bans on exporting crucial technologies needed for oil exploration and production.

- Export Controls: This is where many businesses can easily get tripped up. There is a wide-ranging ban on exporting dual-use goods to Russia. These are items that could have both a civilian and a military purpose—a category that's broader than you might think, covering everything from powerful computers and advanced software to specialised sensors.

Because these pillars overlap, a transaction that seems completely innocent and unrelated to the conflict could still fall foul of the rules. For Dutch businesses, the expectation to comply is high, and enforcement is active and aggressive.

The European Union, including the Netherlands, continues to enforce a robust sanctions regime against Russia. As of September 2025, this framework targets 142 individuals and 134 entities. Non-compliance carries severe risks, with Dutch Customs examining approximately 72,000 shipments to and from Russia and Belarus in just over a year, and the number of criminal investigations surging.

Navigating the SDN List and the 50 Percent Rule

One of the biggest compliance headaches in sanctions 2025: what businesses must know about doing business with Russia, Iran and China is figuring out who you are really doing business with. It’s nowhere near as simple as checking a company's name against an official list.

The US has its list of Specially Designated Nationals (SDNs), and the EU maintains its own consolidated list of sanctioned parties. Any dealings with a person or entity on these lists are strictly forbidden. But the web extends much further, thanks to a crucial principle known as the 50 Percent Rule.

This rule is a notorious trap for the unwary. It states that if one or more sanctioned parties own 50% or more of another company, that company is also considered sanctioned by default. This is true even if the company itself doesn't appear on any sanctions list anywhere.

Imagine this scenario: a sanctioned oligarch secretly owns 25% of Company A and 30% of Company B. Neither company is on a sanctions list. But if you do business with a joint venture owned by Company A and Company B, you could be in violation because the ultimate ownership traces back to a sanctioned person. This is why deep due diligence into the Ultimate Beneficial Ownership (UBO) of any counterparty is non-negotiable. You have to peel back the layers of corporate structure to see who truly stands to benefit. Failing to do this can lead to disaster, as several European firms have discovered after being penalised for working with seemingly legitimate Russian entities.

To get a better sense of how these measures are structured, you can read our guide on the additional sanctions against Russia.

Navigating Sanctions on Iran

The sanctions regime targeting Iran is a complex web of primary and secondary measures, often feeling like a puzzle with interlocking pieces. These sanctions are driven by concerns over Iran's nuclear programme, its regional activities, and its human rights record. For any business outside the United States, especially here in the Netherlands, getting a firm grip on this structure is absolutely critical to avoiding severe penalties.

Unlike the broader sectoral sanctions slapped on Russia, the Iran regime leans heavily on a powerful tool known as US secondary sanctions. This is a concept that every non-US company must understand inside and out.

Think of secondary sanctions as a form of extraterritorial control. Imagine a Dutch logistics company is hired to transport goods for an Iranian entity. Even if the deal involves no US dollars, personnel, or territory, the Dutch firm could face crippling penalties from the US government if that Iranian entity is on a US sanctions list. This could mean being cut off from the US financial system—effectively a death sentence for any international business.

Heavily Restricted Sectors and Prohibitions

The restrictions aren’t spread evenly; they are strategically aimed at specific industries vital to the Iranian economy and its state apparatus. Businesses have to be acutely aware of which sectors carry the highest risk.

Three key areas are under intense scrutiny:

- Energy: Iran’s oil and petrochemical sectors are squarely in the crosshairs. Any significant transaction related to these industries, from investment to providing technology or services, is a quick way to trigger secondary sanctions.

- Shipping and Shipbuilding: The Iranian shipping industry, including major state-owned lines, is extensively designated. This means that providing insurance, flagging services, or even port access can be classed as a violation.

- Finance: A long list of Iranian banks are cut off from the global financial system. Processing transactions through these designated banks, even for what seems like legitimate trade, is a direct path to a violation.

Beyond these sectors, there are strict prohibitions on any activities related to Iran's military and ballistic missile programmes. Selling any goods or technology that could support these efforts is strictly forbidden and aggressively enforced. To truly grasp the challenges here, it's crucial to consider Iran's evolving military landscape and the returning threat of war, as these geopolitical realities directly shape sanctions policies.

A Real-World Example of Sanctions Risk

Let’s make this tangible. A European logistics firm agrees to transport industrial machinery to Iran for a company they believe is a private enterprise. What they don't know is that the Iranian company is secretly owned by an entity on the US Specially Designated Nationals (SDN) list.

Even if the European firm conducted some basic screening, it might easily miss this complex ownership link. When US authorities discover the transaction, they could designate the logistics firm, freeze its US assets, and hit it with millions of dollars in fines. This scenario shows just how essential deep due diligence into ultimate beneficial ownership is when dealing with Iran.

The core danger for non-US businesses is not directly violating their own country's laws, but falling foul of US secondary sanctions. These measures effectively force global businesses to comply with US foreign policy or risk losing access to the world's most important market.

The Myth of Broad Humanitarian Exceptions

A common and dangerous misconception is that humanitarian goods like food and medicine are entirely exempt. While provisions for this kind of trade do exist, they are extremely narrow and fraught with peril. It's not an open channel but a tightly controlled pathway that demands extreme diligence.

To qualify, a transaction for humanitarian goods must not involve any designated Iranian banks, logistics providers, or individuals at any point in the supply chain. Businesses often need a specific license from the US Treasury’s Office of Foreign Assets Control (OFAC), which is notoriously difficult to obtain. Assuming a blanket exemption exists is a dangerous oversimplification and a frequent cause of accidental violations. For any business considering this route, the compliance burden is immense.

The Unique Complexities of China Sanctions

When it comes to China, the sanctions playbook looks entirely different. Unlike the broad, sector-wide restrictions applied to Russia and Iran, measures against China are far more precise, acting like a surgeon's scalpel rather than a sledgehammer. For businesses in the Netherlands, this creates a unique and often subtle set of challenges that are easy to overlook but disastrous to ignore.

Rather than a full country embargo, these sanctions target specific entities, individuals, and technologies. Think of it as placing carefully selected roadblocks around certain high-tech industrial parks, not closing off the entire country's borders. This approach is designed to curb specific behaviours without completely disrupting global trade, but it places a heavy burden on businesses to know exactly who they are dealing with.

The primary drivers behind these targeted measures are serious concerns over human rights, national security, and intense technological competition. A Dutch business could be fully compliant one day and in violation the next, simply because a minor component supplier deep in its supply chain gets added to a sanctions list.

Targeted Sanctions and Supply Chain Risks

The focused nature of China-related sanctions creates enormous risks that ripple right through global supply chains. A company might not be dealing directly with a blacklisted entity, but if one of its suppliers is—or its supplier's supplier—the risk is just as real. This is where many well-intentioned businesses get into serious trouble.

Several key areas are under intense scrutiny:

- Human Rights in Xinjiang: Both the US and EU have imposed sanctions on entities linked to alleged human rights abuses against Uyghurs in the Xinjiang Uyghur Autonomous Region. This includes an effective ban on importing goods, like cotton or electronics, produced using forced labour.

- Military End-User (MEU) Controls: These restrictions prohibit exporting certain technologies or goods to companies identified as having ties to the Chinese military. The MEU list is constantly updated and includes many firms that appear, on the surface, to be purely commercial enterprises.

- Technology Giants and 5G: Specific tech companies, most notably Huawei and others in China's advanced technology sectors, face severe restrictions. These measures are designed to limit their access to crucial components like semiconductors and software developed with US technology.

This precision targeting means that comprehensive due diligence is no longer just a recommendation; it is an absolute necessity for survival. Businesses must be able to trace the origin of their products and verify the end-user of their goods with near-certainty.

The real danger with China sanctions is not a blanket ban, but the hidden connections. A seemingly innocent transaction with a Chinese supplier can become a major violation if that supplier has a hidden link to the military or a designated entity in Xinjiang.

Practical Compliance Challenges

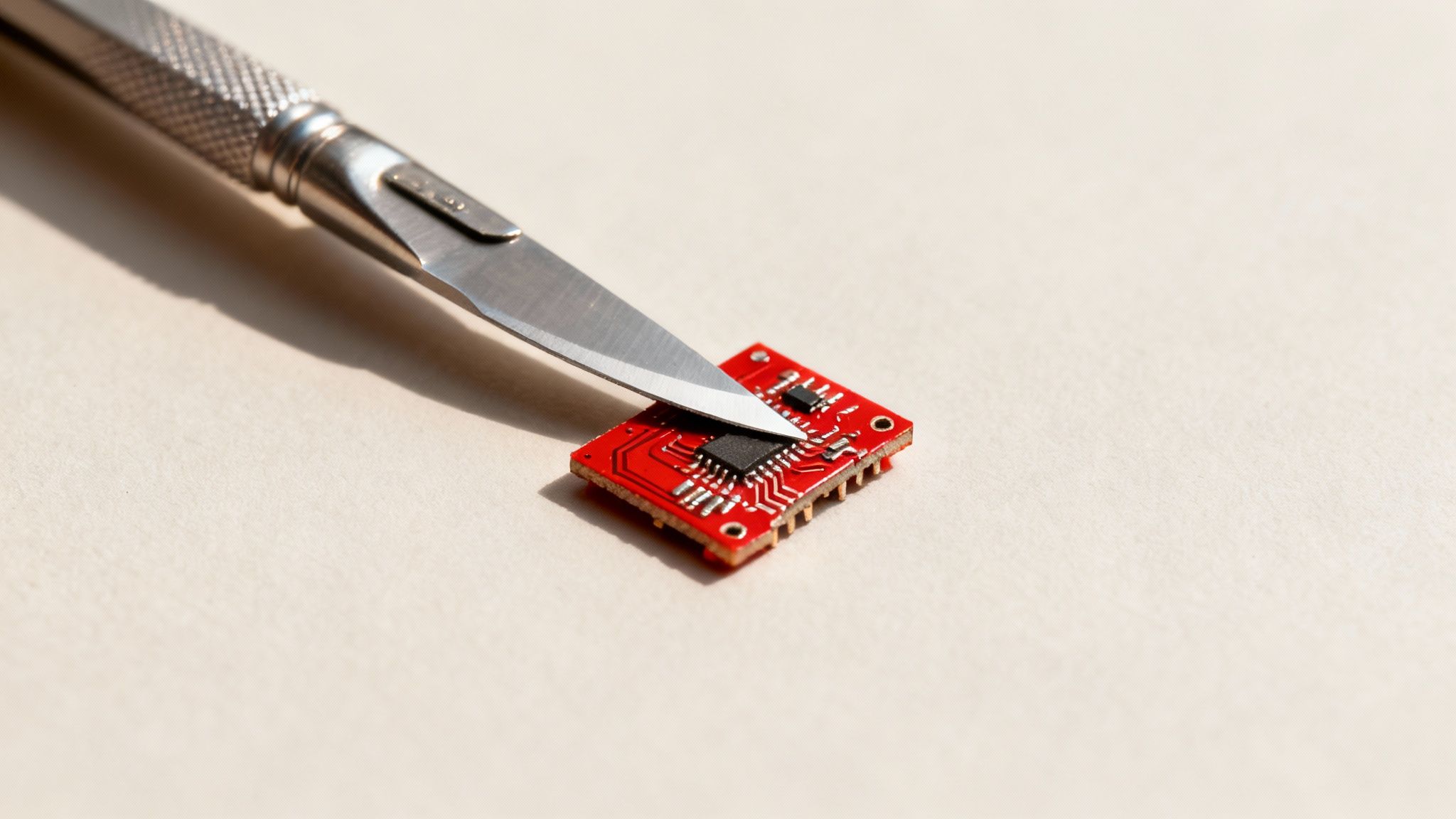

The practical challenges of complying with these rules are immense. For instance, how can a Dutch electronics firm be certain that a tiny capacitor in its circuit board wasn't manufactured by a subsidiary of a sanctioned military end-user? This level of scrutiny requires a far deeper dive than simply screening the name of your direct business partner.

To navigate this landscape, businesses must implement a much more sophisticated compliance strategy. This involves not only screening customers but also mapping out entire supply chains to identify potential exposure to designated entities. The legal penalties for failing to do so are significant, but the reputational damage can be even more severe.

Being associated with forced labour or unknowingly supporting a foreign military can destroy a brand's credibility overnight. Therefore, understanding the nuances of sanctions 2025: what businesses must know about doing business with Russia, Iran and China is crucial for managing these specific, targeted risks.

How to Build a Robust Sanctions Compliance Program

Knowing the rules of the road for Russia, Iran, and China is one thing. Actually putting that knowledge into practice? That’s another challenge entirely. A solid sanctions compliance programme is your company’s active defence system—it’s a living, breathing process, not some document you file away and forget.

At its core, this is all about managing and mitigating business risks. To build something that actually works, it helps to first get your head around the general principles of risk management. From there, we can move from theory to a functional programme built on a few essential pillars. These components work together to shield your business from the severe financial and reputational fallout that violations can cause. EU and Dutch enforcement bodies fully expect businesses to have these systems in place; they see proactive compliance as a fundamental operational responsibility.

Conduct a Tailored Risk Assessment

First things first: you need to look inward. A generic, off-the-shelf compliance plan is next to useless because every business has its own unique risk profile. You have to conduct a thorough risk assessment tailored specifically to how you operate.

This means mapping out every point of exposure. Start by asking some key questions:

- Who are your customers? Where are they located, and what industries do they operate in?

- Where do your products or services end up? You need to trace your supply chain from its origin right through to the final destination.

- Who are your partners? This isn't just about customers. Think suppliers, distributors, agents, and any financial intermediaries you use.

- What are your transaction touchpoints? Do you ever use US dollars or involve US-based banks at any point in your processes?

Answering these honestly will shine a light on the potential weak spots where you might unknowingly brush up against sanctioned parties or jurisdictions. This assessment becomes the very foundation upon which your entire compliance framework is built.

Implement Reliable Screening and Due Diligence

Once you have a clear picture of your risks, the next pillar is screening. This is the daily grind of checking customers, partners, and transactions against the constantly updated sanctions lists from the EU, US (OFAC), UK, and other relevant authorities. But be warned: simple name-checking just doesn’t cut it anymore.

Your screening process has to be sophisticated enough to handle the tricky nuances of modern sanctions, especially the notorious 50 Percent Rule. This often requires performing Enhanced Due Diligence (EDD) on any high-risk partners. EDD is about digging deeper than the surface to investigate a company's Ultimate Beneficial Ownership (UBO), uncovering who really owns and controls it.

This is a critical part of fulfilling your Know Your Customer (KYC) obligations, which are absolutely central to preventing sanctions violations. For a more detailed breakdown, you can explore our https://lawandmore.eu/fearless-kyc-obligations-guide/.

Sanctions compliance is anything but static. The landscape is in constant flux, with lists being updated and new restrictions appearing overnight. Continuous monitoring is essential to ensure a transaction that was perfectly fine yesterday is still compliant today.

Establish Clear Protocols and Training

A compliance programme is only as strong as the people running it. It is vital to establish clear, written procedures for your team to follow. This must include a step-by-step protocol for what to do the moment a potential match or "red flag" pops up during screening.

Staff training isn't a "nice to have"—it's non-negotiable. Everyone, from your sales team to the finance department, needs to understand the basics of sanctions, know how to spot red flags, and be clear on how to report concerns. This fosters a true culture of compliance where everyone shares the responsibility for protecting the business.

Finally, embedding strong sanctions clauses into your contracts is a crucial legal backstop. These clauses should give you the right to suspend or even terminate a contract without penalty if a partner suddenly finds themselves on a sanctions list. It's a simple step that protects you from being locked into a prohibited business relationship.

Your Top Sanctions Questions Answered

When you're dealing with sanctions, the theory is one thing, but the real world is messy. Questions and 'what if' scenarios are bound to pop up, and getting the answers wrong can be incredibly costly. Let's tackle some of the most common and tricky situations businesses run into.

What Happens if a Partner Is Sanctioned After We Sign a Contract?

This is the scenario that keeps compliance officers up at night, and for good reason. If a business partner gets hit with sanctions after you've signed a contract, the rule is simple and absolute: you must immediately stop all prohibited activities with them.

There’s no grey area here. That means payments stop, shipments are halted, and services cease. Your first call should be to legal counsel who specialises in sanctions law. They can walk you through your specific obligations, which might include using legal "wind-down" provisions that can sometimes grant a brief window to terminate your operations cleanly.

Any modern, properly drafted contract should have robust sanctions clauses baked right in. Think of these as your legal eject button, clearly stating how the agreement can be suspended or torn up if one party lands on a sanctions list. Trying to find a clever workaround is a terrible idea and can lead to staggering fines. You may also be required to freeze any assets of the sanctioned partner that you hold and report this to the relevant authority, like the Dutch Central Bank (DNB).

Can We Be Penalised for Dealing with a Company Owned by a Sanctioned Person?

Yes, absolutely. This is one of the most common traps in sanctions compliance, and it's governed by strict ownership rules, most notably the EU and US '50 Percent Rule.'

The principle sounds straightforward: if one or more sanctioned people or companies own 50% or more of another company, that company is also considered sanctioned by extension. This holds true even if the company itself doesn't appear on any official sanctions list.

Dealing with a company that is 50% or more owned by a sanctioned party is legally the same as dealing directly with the sanctioned party themselves. Ignorance of the ownership structure is not a valid defence.

This is exactly why a quick name-check against a sanctions list is never enough. You have to dig deeper and conduct thorough due diligence into the Ultimate Beneficial Ownership (UBO) of your partners, especially when operating in high-risk regions. It’s about peeling back the corporate layers to see who really owns and controls the entity you're doing business with. Without that deep dive, you’re flying blind.

Are Humanitarian Goods Like Food and Medicine Exempt?

While it’s true that many sanctions regimes have provisions for humanitarian aid, assuming there's a blanket exemption for things like food and medicine is a massive and dangerous oversimplification. These exceptions are incredibly narrow and riddled with compliance pitfalls.

Any transaction involving humanitarian goods has to be structured perfectly to ensure no designated parties are involved at any stage. For example:

- The food itself might be permissible to export.

- But if you use a sanctioned Iranian bank to handle the payment, the entire transaction becomes illegal.

- If you contract a designated Russian logistics firm to transport the medicine, you've just broken the law.

Companies working in this area must perform exhaustive due diligence on every single entity in the supply chain—from the bank and insurer to the shipping line and the final recipient. Often, you'll need to apply for a specific licence from authorities like OFAC or a national EU body. These aren't handed out easily and require a mountain of paperwork. The takeaway is clear: humanitarian exemptions aren't an open door; they're a tightly controlled corridor that demands flawless compliance.

Which Sanctions Do We Need to Follow: EU or US?

For any business based in the Netherlands, the answer is both demanding and straightforward: you effectively need to comply with both.

As a Dutch company, you are legally bound to follow all EU and Dutch national sanctions. That's non-negotiable. But the powerful 'extraterritorial' reach of US sanctions means you simply cannot afford to ignore them, no matter where you're based.

This is especially true for US 'secondary sanctions,' which are designed to penalise foreign companies for doing business with sanctioned countries like Iran—even if that business is perfectly legal under EU law. US jurisdiction can be triggered in a number of ways:

- Using US dollars for the transaction.

- Routing payments through US banks, even as intermediaries.

- Involving US persons (citizens or residents).

- Using US-origin goods or technology.

Because of this far-reaching influence, most international companies simply adopt a policy of complying with both regimes. This means applying the strictest rule as your global standard. It's the only truly safe way to manage risk in the complex world of sanctions 2025: what businesses must know about doing business with Russia, Iran and China.