When it comes to mergers and acquisitions in the tech sector, the opportunities are massive. But so are the risks. A deal that looks fantastic on paper can quickly unravel, destroying value if critical issues are overlooked during due diligence. This is your essential safeguard—a deep dive that goes far beyond a standard financial audit to uncover the hidden liabilities unique to technology companies, like intellectual property integrity, cybersecurity resilience, and data privacy compliance.

Navigating High Stakes in Dutch Tech M&A

Welcome to the fast-paced world of Dutch tech M&A. The Netherlands is a major hub in Europe's digital economy, and while deals are happening all the time, many fail to deliver on their initial promise. Why? Because critical risks were missed during the due diligence phase.

This guide is designed to cut through the complexity. We're offering actionable strategies to de-risk your next tech acquisition, exploring the unique challenges of valuing intangible assets and navigating ever-shifting regulations. Think of this as your roadmap to a successful transaction, showing exactly why a tech-specific due diligence process is the key to protecting your investment.

The Netherlands is a truly vibrant market for technology deals. Between 2018 and 2023, the country consistently ranked among Europe’s most active hubs for mid-market tech M&A. An estimated 20–25% of all deals involved technology, media, and telecom targets. More recently, that figure has climbed, with around 30% of announced Dutch deals having a strong digital or tech component.

But here’s the cautionary tale. Studies of European tech acquisitions reveal a sobering reality: only about 50–60% of buyers actually achieve their expected synergies within three years. Even worse, more than 30% report value erosion due to integration problems. This is a risk that’s particularly pronounced in cross-border transactions involving Dutch targets. You can find more insights on this topic in our general overview of M&A trends in the Netherlands.

Why Tech M&A Demands a Specialised Approach

Unlike traditional mergers, tech acquisitions are built on assets that are often intangible and incredibly difficult to value. The real heart of a tech company lies in its intellectual property, its code, and the expertise of its people. These elements introduce distinct risks that a generic due diligence checklist will simply glide over.

A specialised approach is absolutely necessary to get to grips with several critical areas:

-

Intellectual Property (IP): Verifying the ownership and integrity of source code, patents, and trademarks is paramount. Uncovering an open-source licence violation or an unresolved IP claim from a former employee can prevent a catastrophic liability down the line.

-

Data Privacy and Cybersecurity: In an era of stringent regulations like the GDPR, assessing a target's data handling practices and cybersecurity posture is non-negotiable. An undisclosed data breach from years ago can resurface, leading to massive fines and crippling reputational damage.

-

Talent Retention: The "acqui-hire" is common in the tech world, where the main goal is to bring a skilled engineering team on board. Proper due diligence must evaluate employment contracts, compensation structures, and cultural fit to ensure your key people don't walk out the door the day after the deal closes.

Failing to properly investigate these tech-specific areas can turn a promising acquisition into a very costly mistake. This guide will provide the practical framework you need to navigate these complexities effectively and secure your investment.

Your Core Tech Due Diligence Checklist

Forget the generic M&A playbook. A tech deal is a different beast entirely, demanding a forensic investigation into the very assets that make up the company’s foundation. A standard checklist just won’t cut it when you need to uncover the nuanced risks hidden in source code, data flows, and intellectual property.

This framework lays out the essential documents you need to get your hands on and the critical questions your team must ask.

A meticulous process is non-negotiable. For a broader overview of the general principles, our guide on due diligence investigations in the Netherlands offers some valuable context. But when it comes to tech M&A, the focus gets much, much sharper.

Intellectual Property Deep Dive

Let's start with the crown jewels of any tech company: its intellectual property (IP). Verifying the ownership and integrity of the IP is your absolute first priority. This isn’t just about checking for patents; it’s about dissecting how the company's core value was created and how it's been protected since day one.

Begin by requesting a complete IP portfolio. This should include:

-

Registered IP: A full schedule of all registered and pending patents, trademarks, and design rights, complete with registration numbers and the jurisdictions where they apply.

-

Unregistered IP: You need detailed descriptions of trade secrets, proprietary algorithms, and crucial know-how. How are these documented? More importantly, how are they kept secret?

-

Chain of Title: This is crucial. You need hard evidence that all IP created by founders, employees, and contractors has been legally assigned to the company. Scrutinise the IP assignment clauses in every single employment and consultancy agreement.

A huge red flag is any ambiguity around who owns what. For instance, if a key algorithm was developed by a founder before the company was officially incorporated, was it ever formally transferred? A missing paper trail here is a massive liability waiting to happen.

Scrutinising the Codebase and Open-Source Software

The target’s software isn't just an idea; it's a tangible asset that needs a thorough audit. This goes way beyond making sure the code works. You're looking for hidden dependencies and legal landmines that could contaminate your own IP after the acquisition. One of the biggest culprits here is open-source software (OSS).

OSS is a fundamental part of modern software development, but certain licences—especially 'copyleft' licences like the GNU General Public License (GPL)—can be a real nightmare. These licences often come with a nasty string attached: they can require that any software built using them must also be made open source.

Key Takeaway: If the target company has unknowingly baked GPL-licensed code into its core proprietary product, you could find yourself legally forced to release your own source code to the public. This can completely destroy the commercial value of the very asset you’re trying to buy.

Your technical team must run a full code scan using specialised tools. The goal is to identify every open-source component and its associated licence. You need to create a complete Bill of Materials (BOM) for the software and assess the compliance risk for every single licence involved. No exceptions.

Cybersecurity and Data Privacy Compliance

In today's world of intense regulatory scrutiny, a target’s cybersecurity posture and data privacy practices can hide enormous liabilities. An undisclosed data breach or a failure to comply with regulations like GDPR or the upcoming NIS2 Directive could lead to eye-watering fines and destroy your reputation.

Your due diligence here must include a proper vulnerability assessment. This means:

-

Penetration Testing: Hire ethical hackers to actively probe the target's systems for weaknesses.

-

Reviewing Security Audits: Get your hands on all past internal and external security audits and certifications. A critical part of any tech due diligence is verifying robust security controls, often proven by credentials like a SOC 2 Type II certification for data security.

-

Incident Response Plans: How prepared are they for a breach? You need to see a clear, well-tested plan.

On the data privacy front, demand all documentation related to GDPR compliance. This means seeing their Data Protection Impact Assessments (DPIAs), records of processing activities (ROPA), and the evidence they have for a lawful basis to process personal data.

The fundamental question is whether the company's data practices can actually withstand regulatory inspection. Any shortcuts or gaps you find must be priced into the deal's valuation and risk profile.

To help structure your investigation, here's a breakdown of the key areas to focus on in any tech M&A deal. Think of it as your high-level map for navigating the complexities ahead.

Critical Due Diligence Focus Areas in Tech M&A

| Focus Area | Primary Objective | Common Red Flags to Investigate |

|---|---|---|

| Intellectual Property | Verify undisputed ownership and freedom to operate. | Missing IP assignment clauses, founder IP not formally transferred, disputes over prior art. |

| Codebase & OSS | Identify all software components and assess licence compliance risk. | Use of 'copyleft' (e.g., GPL) licences in proprietary code, lack of an OSS policy, no software BOM. |

| Cybersecurity | Assess the target's security posture and identify vulnerabilities. | No recent penetration tests, history of undisclosed breaches, lack of basic security controls (e.g., MFA). |

| Data Privacy | Ensure compliance with regulations like GDPR and avoid hidden liabilities. | No records of processing activities (ROPA), ambiguous user consent mechanisms, cross-border data transfer issues. |

| Key Personnel | Secure critical talent and assess employee-related risks. | Key engineers without non-compete clauses, over-reliance on a few "hero" developers, misclassified contractors. |

| Commercial Contracts | Understand key customer/supplier agreements and change-of-control clauses. | Major contracts that terminate upon acquisition, unfavourable auto-renewal terms, customer concentration risk. |

| Regulatory & Compliance | Check adherence to sector-specific laws (e.g., FinTech, HealthTech). | Lack of required licences or certifications, ongoing regulatory investigations, non-compliance with industry standards. |

| Tax & Financials | Validate financial statements and identify tax liabilities. | Unrecognised R&D tax credits, complex international tax structures, inconsistent revenue recognition. |

Each of these areas can hide deal-breaking issues. A thorough, systematic approach is the only way to protect your investment and ensure you're buying the asset you think you are.

Uncovering Hidden Commercial and Operational Risks

While a deep dive into code and IP is non-negotiable, a tech company's true value is often tied up in less tangible assets. We're talking about its customer relationships, its talent, and its underlying financial health. It’s a classic pitfall in tech M&A to focus solely on the tech and overlook these crucial commercial and operational aspects. These are the risks that don't show up in a code scan but can absolutely torpedo a deal's success down the line.

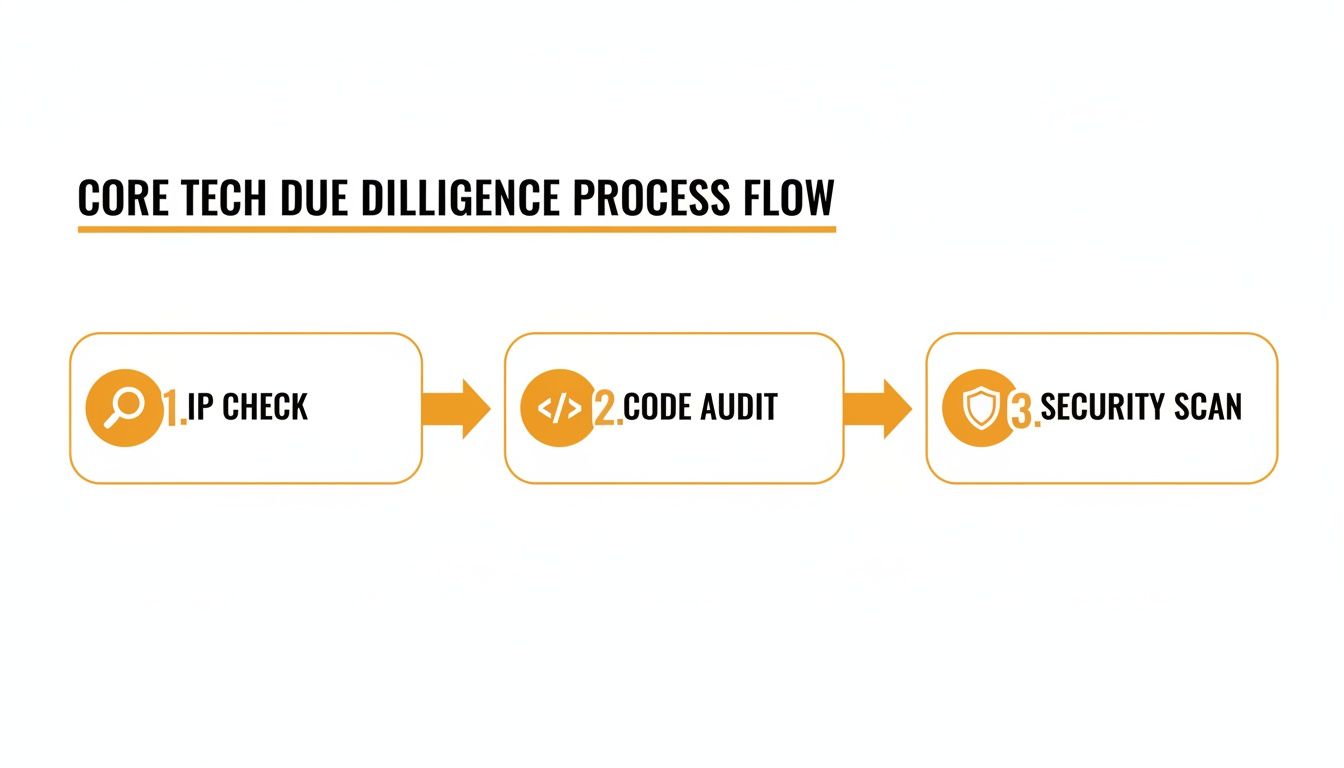

The core technical due diligence process is your foundation, but it's just the start.

This process—checking the IP, auditing the code, and scanning for security flaws—sets the stage. It gives you the technical context you need before you can properly evaluate the commercial realities of the business.

Scrutinising Key Customer and Supplier Contracts

A tech company's contracts can be a minefield of hidden liabilities. Your first job is to get your hands on all major customer and supplier agreements and start analysing. You're hunting for specific clauses that could be triggered by an acquisition.

A change-of-control clause is a prime example. These clauses can give a key customer or a critical vendor the right to terminate their contract simply because the company has been sold. Imagine losing your largest customer or a sole-source supplier on day one. That's a catastrophic failure of due diligence.

Equally important is looking at customer concentration. If 70% of the target's revenue comes from a single client, your investment is incredibly fragile. You have to understand the health of that relationship inside and out, especially the renewal terms of their contract.

Evaluating Talent and Human Capital

In so many tech deals, you're acquiring the team just as much as the technology. Keeping key engineers, data scientists, and product managers on board is often what makes or breaks the deal's value. Your due diligence has to extend to a proper review of human resources.

Here's what to dig into:

-

Employment Agreements: Do they have clear IP assignment clauses ensuring all work product belongs to the company? Are the non-compete and non-solicitation clauses actually enforceable under Dutch law? You'd be surprised how often they aren't.

-

Key Personnel Risk: Pinpoint the individuals who are truly indispensable. What are their compensation packages, and what's their motivation to stay after the acquisition? You need a solid plan to retain them with the right incentives baked into your strategy.

-

Contractor vs. Employee Status: Misclassifying employees as independent contractors is a common shortcut for startups. This can blow up into significant back-tax liabilities and other legal headaches you don't want to inherit.

One of the biggest hidden operational risks in tech M&A is undiscovered technical debt. A huge part of your diligence is understanding the target's approach to managing technical debt. You need to be sure you aren't acquiring a product that will be a nightmare to maintain and scale.

Deep Dive into Financial and SaaS Metrics

The financial health of a tech company, especially a SaaS business, demands a specialised lens. Standard accounting metrics just don't tell the full story. You have to get under the hood and validate the key performance indicators (KPIs) that really drive a modern tech valuation.

A critical mistake is taking the target's reported SaaS metrics at face value. Inflated metrics can mask an unhealthy business model, and it's your job to verify the numbers from the ground up.

Specifically, your financial diligence must rigorously pick apart:

-

Customer Acquisition Cost (CAC): How much does it really cost to land a new customer? Make sure every single marketing and sales expense is correctly attributed.

-

Lifetime Value (LTV): This metric predicts the total revenue a business can expect from a single customer. An inflated LTV can be a massive red flag, so scrutinise the churn rate and revenue-per-user assumptions they're using.

-

Churn Rate: You must distinguish between customer churn (losing clients) and revenue churn (losing recurring revenue). A low customer churn rate can easily hide a high revenue churn if your most valuable clients are the ones walking out the door.

Understanding the nuances of these agreements is vital. For more detailed insights, you can explore our article on the hidden risks of SaaS contracts and data ownership.

Mastering Dutch Regulatory and Tax Hurdles

When international buyers look at the Netherlands, it’s easy to underestimate the local regulatory and tax landscape. While the country is famously business-friendly, its specific legal frameworks can spring some costly surprises if you don't tackle them correctly during due diligence. Overlooking these Dutch nuances is a classic pitfall in cross-border tech M&A.

To navigate this terrain, you need more than a standard legal check. It demands real insider knowledge of how Dutch authorities interpret and enforce the rules, especially when it comes to the technology sector.

The Vifo Act: A Critical New Hurdle

One of the biggest recent changes is the Dutch National Security Investment Act, known locally as the Wet veiligheidstoets investeringen, fusies en overnames (Vifo). This law was created to screen investments in sectors considered vital to national security, and it has massive implications for tech M&A.

The Vifo act kicks in for acquisitions involving providers of 'sensitive technologies'. This is a pretty broad category that can cover anything from dual-use products and quantum technology to semiconductors and certain high-assurance IT used by the government.

A common mistake is failing to appreciate just how wide the Vifo's net is cast. If your target company’s tech falls under this definition, the deal absolutely must be reported to the Dutch Bureau for Investment Screening (BIV). The BIV then has the power to impose conditions on the transaction or, in the most serious cases, block it entirely.

Practical Tip: Don't leave Vifo until the last minute. Make a preliminary Vifo check one of your first due diligence steps. Discovering you need to notify the BIV late in the game can derail your entire timeline and inject a huge amount of uncertainty into the deal.

Getting this wrong has serious consequences. Failing to report a notifiable transaction can lead to fines of up to 10% of the company's annual turnover. Even worse, the BIV has the authority to unwind a deal that has already closed if it's later discovered that the act was violated.

Untangling Dutch Tax Complexities

Beyond the regulatory gates, the Dutch tax system has its own set of incentives and rules that are highly relevant for tech companies. Getting a firm grip on the target's tax position is essential to avoid inheriting unexpected liabilities or finding out that the benefits you thought you were acquiring don't actually exist.

Your tax due diligence needs a sharp focus on a few key areas that are specific to the Dutch tech scene:

-

The 30% Ruling: This is a major tax perk for attracting highly skilled talent from abroad, allowing employers to pay 30% of an employee’s salary tax-free. Your diligence team must confirm exactly which employees have this ruling, when it expires, and whether the company has kept up with all the administrative rules. If key staff lose this benefit post-acquisition, your operational costs could jump significantly.

-

R&D Tax Credits (WBSO): The WBSO scheme offers a wage tax credit for businesses doing research and development. You need to verify that the target's R&D work genuinely qualifies and that they've kept meticulous records to prove it. Dutch tax authorities are famously strict during audits, and any disallowed credits will have to be repaid, often with hefty penalties.

-

Transfer Pricing Issues: Many Dutch tech companies have an international footprint, which immediately brings transfer pricing risks into play. You have to scrutinise all intercompany transactions to make sure they are conducted at arm's length. A common red flag is seeing a Dutch subsidiary holding valuable IP but having very little substance—meaning few employees or real operations—which is a magnet for challenges from tax authorities in multiple countries.

By tackling these Dutch-specific regulatory and tax issues head-on with a focused, expert approach, you can sidestep the common traps that ensnare so many international buyers. This isn't just about ticking boxes; it's a fundamental part of de-risking your investment and setting up your acquisition for long-term success in the Netherlands.

Turning Due Diligence Findings into Actionable Solutions

Discovering problems during due diligence isn't about killing the deal; it's about making it smarter. The findings from your deep dive are not just red flags—they are powerful negotiating tools. A well-executed investigation gives you the leverage to de-risk the transaction and ensure you're not paying for hidden liabilities. The real skill lies in transforming what you've found into tangible, actionable solutions.

Finding problems is only half the battle. Solving them is what defines a successful acquisition. This phase is where your team’s hard work translates directly into value protection, shaping the deal's final terms and setting the stage for a smooth post-merger integration.

Leveraging Findings for Contractual Protections

Every issue you uncover is a chance to strengthen the acquisition agreement. Think of these contractual protections as your financial safety net, shifting the risk of specific, identified problems back onto the seller.

Your first and most direct tool is the purchase price adjustment. If you discover the target's customer churn is higher than reported, or that their key software needs an expensive overhaul to fix technical debt, you have a solid basis to argue for a lower valuation. It’s a straightforward negotiation backed by concrete evidence.

Another powerful mechanism is securing specific indemnities. These clauses force the seller to compensate you for losses that come from a particular known risk. For instance:

-

IP Indemnity: If you found a potential patent infringement claim, you can negotiate an indemnity that covers all future legal costs and damages related to that specific issue.

-

Data Breach Indemnity: If the cybersecurity audit revealed a past, undisclosed data breach, an indemnity can cover the costs of potential regulatory fines or customer lawsuits down the line.

-

Tax Indemnity: Perhaps the tax review uncovered some shaky R&D tax credit claims. In that case, an indemnity can make the seller responsible for repaying any disallowed credits post-acquisition.

These indemnities aren't generic; they are surgical tools designed to isolate and neutralise specific risks you've identified.

Using Earn-Outs to Bridge Valuation Gaps

What happens when you and the seller just can't agree on the company's future potential? This is a classic sticking point in tech M&A, where valuations often hinge on ambitious growth forecasts. The earn-out is the perfect way to bridge this gap.

An earn-out is a contractual provision where a portion of the purchase price is paid out only if the acquired business hits certain performance goals after the deal closes. This structure aligns everyone's interests. If the company performs as well as the seller claimed, they get their full payout. If it underperforms, you're protected from having overpaid.

Key Takeaway: For an earn-out to work, the performance metrics must be crystal clear and objective. Ambiguous targets like "successful product integration" are a recipe for future disputes. Instead, use concrete, measurable KPIs like hitting a specific Annual Recurring Revenue (ARR) target or achieving a certain customer retention rate.

Crafting these metrics requires careful thought. They have to be directly tied to the value drivers of the business and be within the control of the post-acquisition management team.

Building a Data-Driven Integration Roadmap

Finally, the insights from your due diligence are the very foundation of a successful post-merger integration. So many deals fail not because the asset was bad, but because the integration was poorly planned. Research consistently shows that a staggering 70-90% of mergers fail to achieve their intended goals, often due to these very integration challenges. Your diligence findings provide a detailed blueprint for what needs to be done from day one.

For example, if you discovered the target’s engineering team operates on a completely different software development lifecycle, you can plan for the necessary training and process alignment immediately. If you identified key customers whose contracts are at risk of non-renewal, your integration plan can prioritise outreach to secure those relationships right out of the gate.

Your integration roadmap should be a direct response to your diligence report, turning each identified weakness into a specific task with a clear owner and timeline. This transforms due diligence from a simple risk assessment into a strategic tool for creating long-term value and making sure you actually realise the synergies you’re paying for.

Frequently Asked Questions About Tech M&A Due Diligence

Even the most detailed guides on tech mergers and acquisitions can leave you with some nagging, practical questions. This section dives into the sort of nuanced issues that frequently pop up during the intense due diligence phase, offering direct insights for teams navigating the critical final stages of a deal.

How Should We Handle Undocumented IP From Key Founders?

This is a classic problem, especially with early-stage tech companies. A founder often develops a core algorithm, a crucial piece of code, or the initial product prototype long before the company was even officially registered. If there's no clear paper trail showing that this intellectual property was formally assigned to the business, you're looking at a serious ownership gap.

The only way forward is to tackle this directly and make it a condition of closing the deal. This nearly always means drafting and executing a confirmatory IP assignment agreement with the founder in question. This legal document retroactively confirms that all relevant work done before incorporation is, and always has been, the property of the company. Never, ever proceed on a verbal promise; this needs to be locked down in a legally binding document.

What Is The Most Overlooked Risk In Early-Stage Tech Deals?

While everyone rightly focuses on IP audits and code reviews, a risk that frequently slips under the radar is the misclassification of employees as independent contractors. Young startups often rely heavily on contractors to stay agile and manage costs, but the lines can become dangerously blurred, particularly under Dutch employment law.

If individuals classified as contractors are effectively acting like employees—working exclusively for the company, using its equipment, and taking direct instruction from management—they may legally be considered employees. Inheriting this kind of liability can open your company up to a nasty surprise of back taxes, overdue social security contributions, and even potential wrongful termination claims down the line. A thorough review of all contractor agreements and, more importantly, their actual day-to-day working relationships is an absolute must.

How Can We Quantify The Risk Of Technical Debt?

Technical debt—that hidden cost of rework caused by taking an easy shortcut now instead of using a better, more robust approach—is a major liability lurking in many tech acquisitions. While you won't see it listed on a balance sheet, you absolutely can and should quantify its potential impact.

Your technical due diligence team's job is to hunt for the signs of significant debt in the codebase: a lack of clear documentation, needlessly complex or 'spaghetti' code, and the use of outdated libraries or frameworks. From there, they can estimate the man-hours and associated costs it would take to refactor the code and bring it up to a sustainable, scalable standard. This figure gives you a concrete number to work with, which you can then use to negotiate a reduction in the purchase price or secure an indemnity to cover the remediation costs after the acquisition.

A key part of due diligence is understanding that a target’s valuation should reflect not just its current revenue, but the future investment needed to maintain and scale its technology. Significant technical debt directly impacts this calculation.

At Law & More, our corporate and contract law specialists provide expert guidance through every stage of your tech M&A transaction. We ensure your due diligence is thorough, protecting your interests and maximising the value of your acquisition in the Netherlands. Contact us to learn how our dedicated team can support your next strategic move by visiting https://lawandmore.eu.